Asset In Accounting Examples

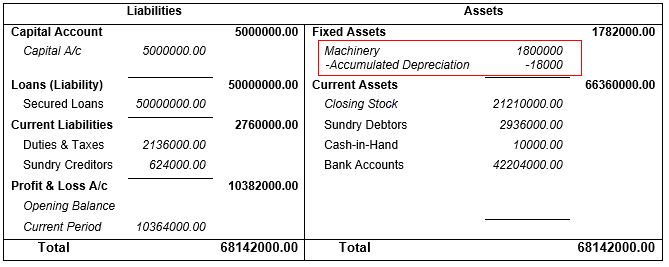

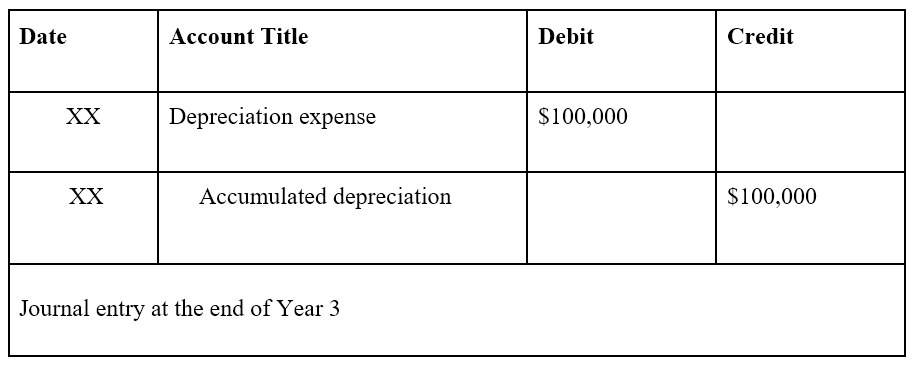

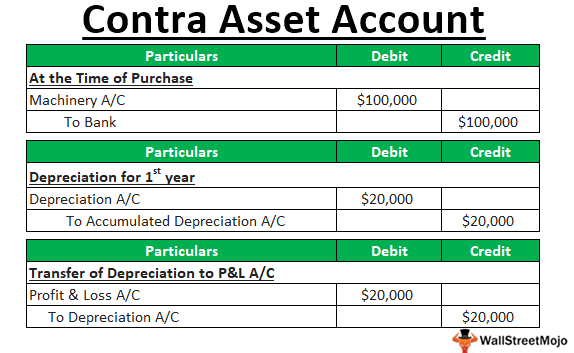

Common examples of contra assets include Accumulated depreciation Accumulated Depreciation Accumulated depreciation is the total amount of depreciation expense Allowance for doubtful accounts Allowance for Doubtful Accounts The allowance for doubtful accounts is a contraasset Reserve for.

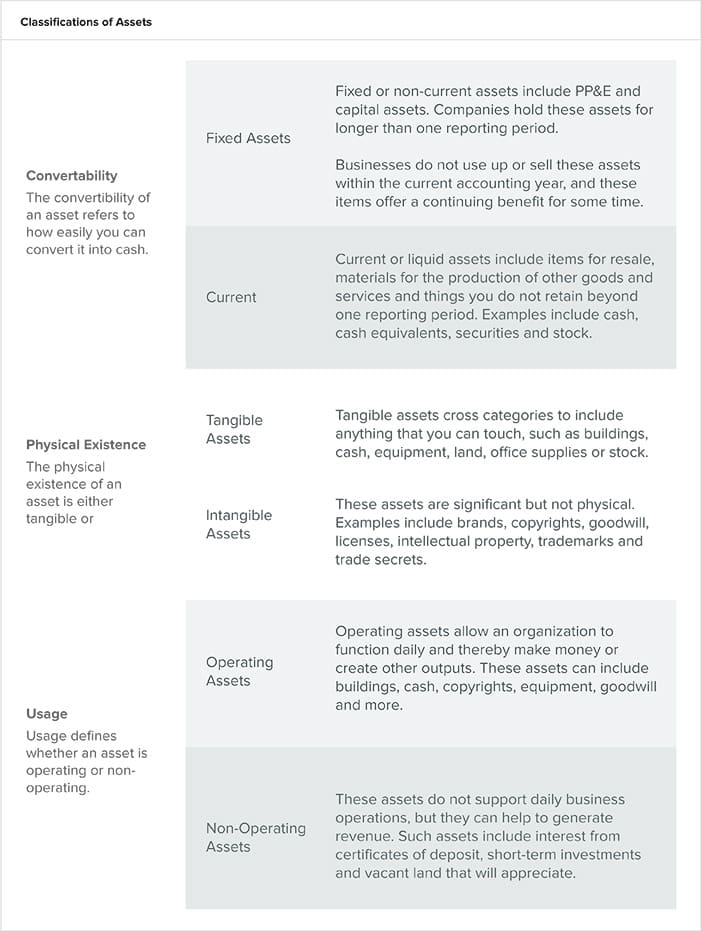

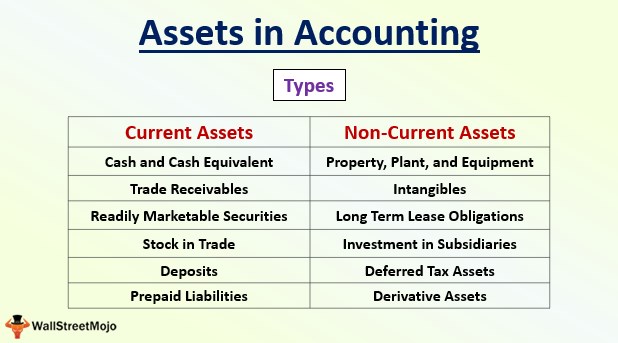

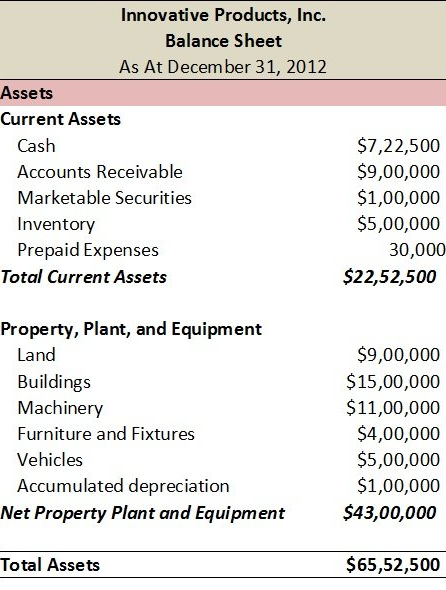

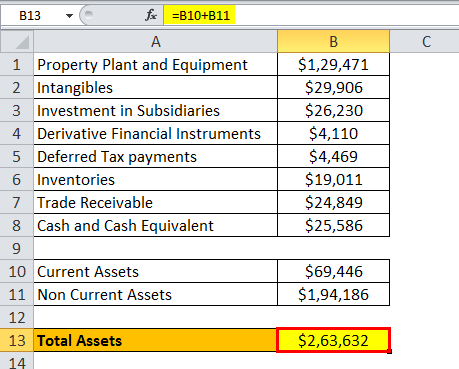

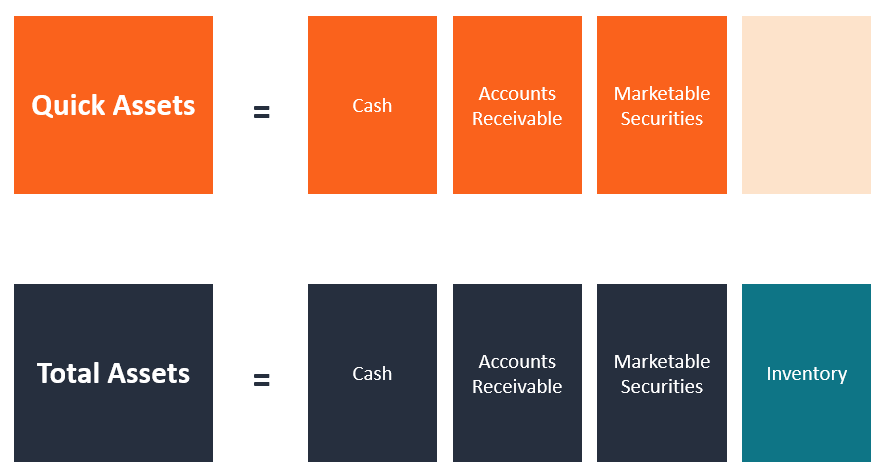

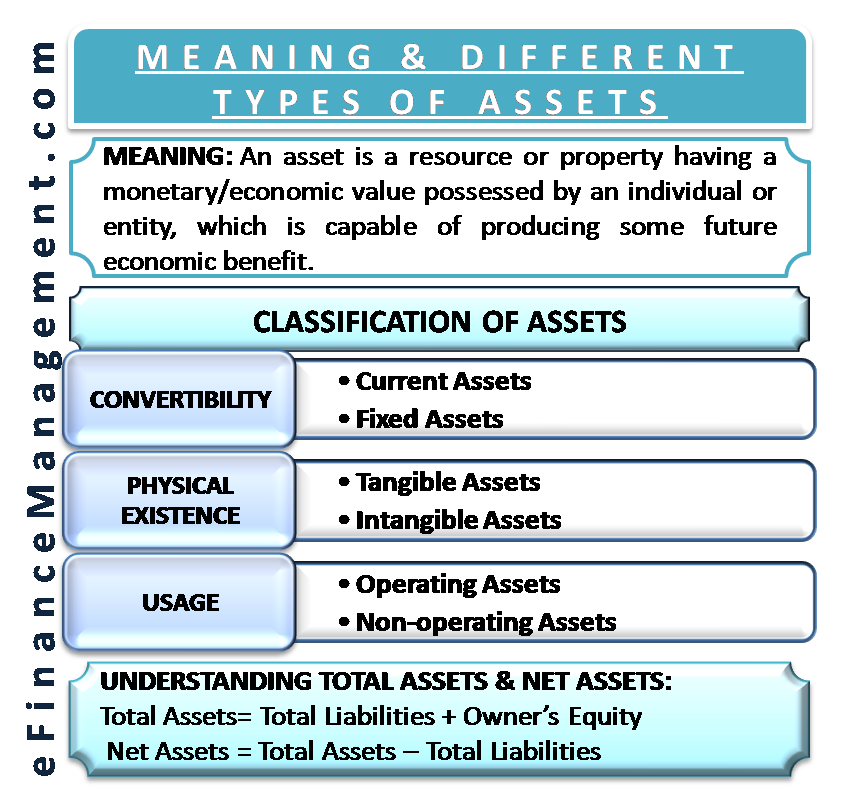

Asset in accounting examples. Taxes Receivable A pending tax refund or refundable tax credit that is applicable to the fiscal year An asset that is easily converted to cash or expected to be converted to cash within a fiscal year or operating cycle. For example, understanding which assets are current assets and which are fixed assets is important in understanding the net working capital of a company In the scenario of a company in a highrisk industry, understanding which assets are tangible and intangible helps to assess its solvency and risk. In accounting terms, any asset expected to the sold for cash or cash equivalent value within a period of one year or within accounting cycle is known as “Current Asset” Examples of current asset include Cash, debt claims, stock, account receivable, inventory, prepaid expenses, shortterm investments and other liquid asset that can be converted to cash Current assets are essential to individuals or organizations on the grounds that they can be utilized fund for paying daytoday.

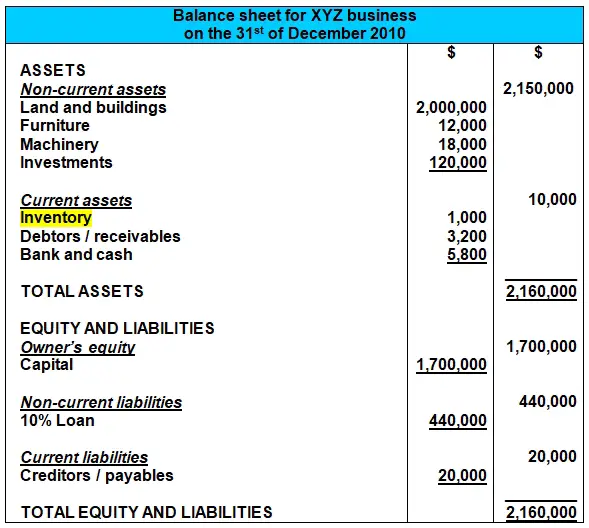

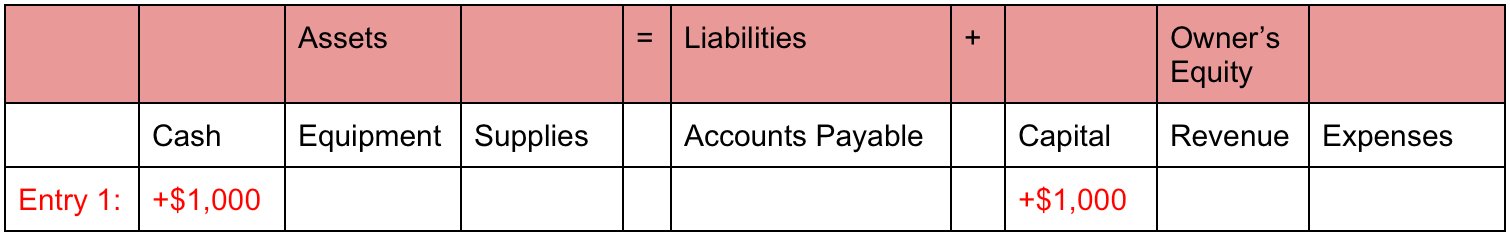

Here are some subaccounts you can use within asset, expense, liability, equity, and income accounts Asset accounts Assets are the physical or nonphysical types of property that add value to your business For example, your computer, business car, and trademarks are considered assets Some examples of asset subaccounts include Checking. Computer and its equipment’s;. Example Let’s assume, Mr Bill is the sole proprietor of XYZ Co (ASC) On December 1, 18, Mr Bill invests personal funds of $10,000 to start XYZ Co So after this transaction, the accounting equation will be, Assets ( $10,000) = Liabilities (No effect) Owner’s equity ( $10,000).

Assets are persons or things that can produce value People can be assets because of the value they bring to a relationship or organization Things which are assets have value for the owner because they can be converted into cash Cash on hand is also considered an asset. Understanding the Asset Ledger When a business undertakes any transaction, it will record a journal entry for both sides of the transaction Examples of typical business transactions include. Assets are economic resources controlled by a business which can potentially benefit its operations or are convertible to cash (cash itself is also an asset) Examples of Assets Following are the common assets of a business Cash Cash includes physical money such as bank notes and coins as well as amount deposited in bank for current use.

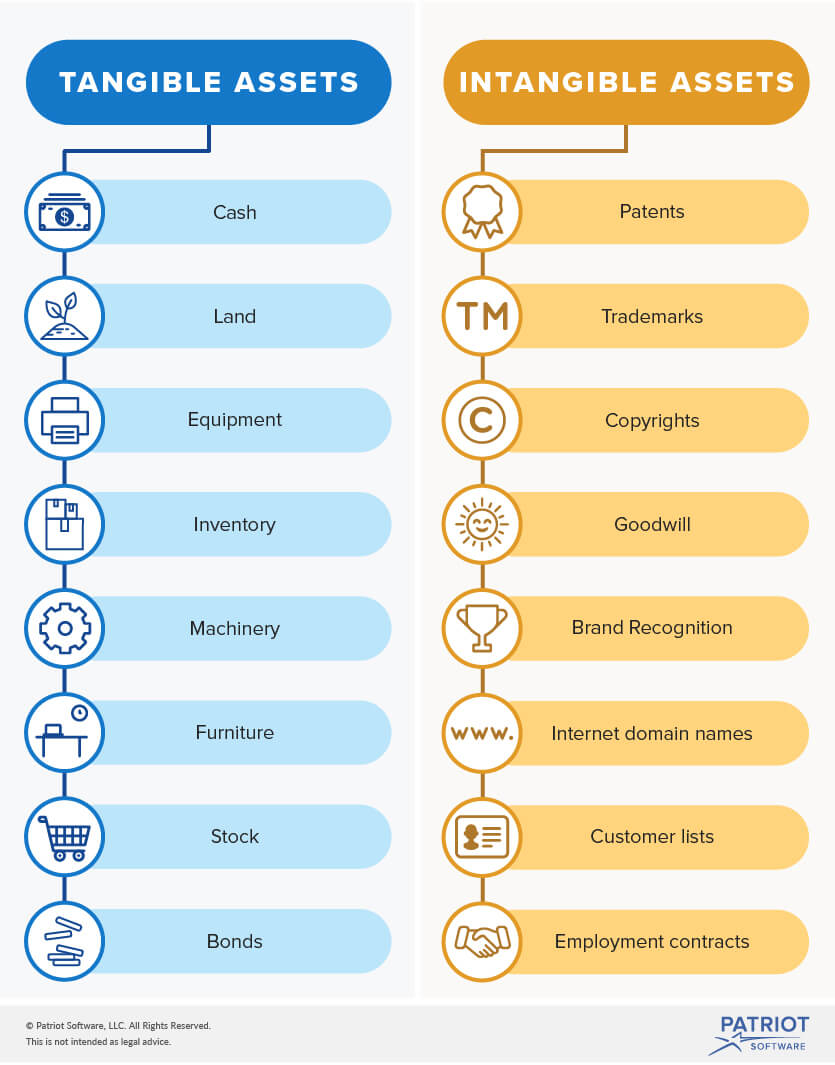

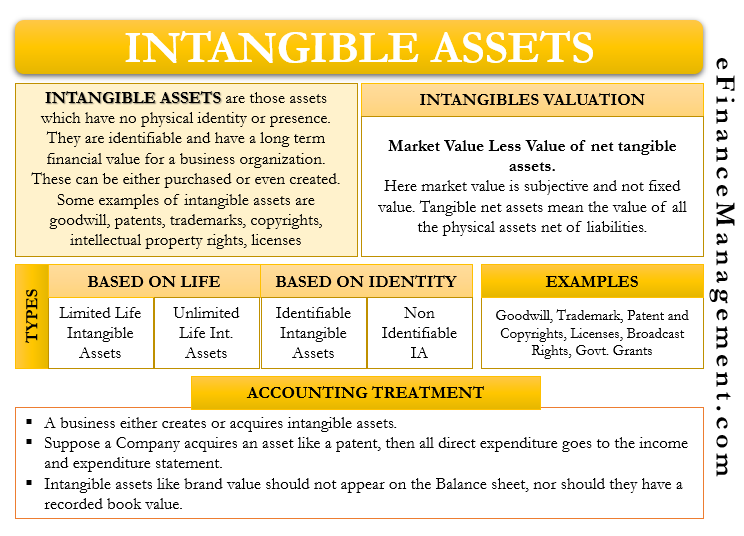

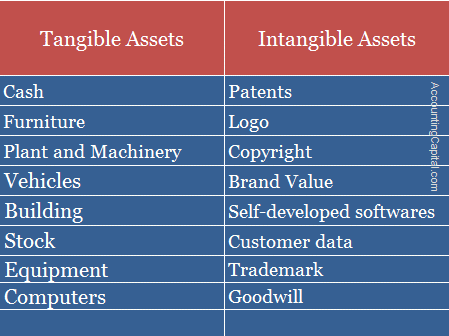

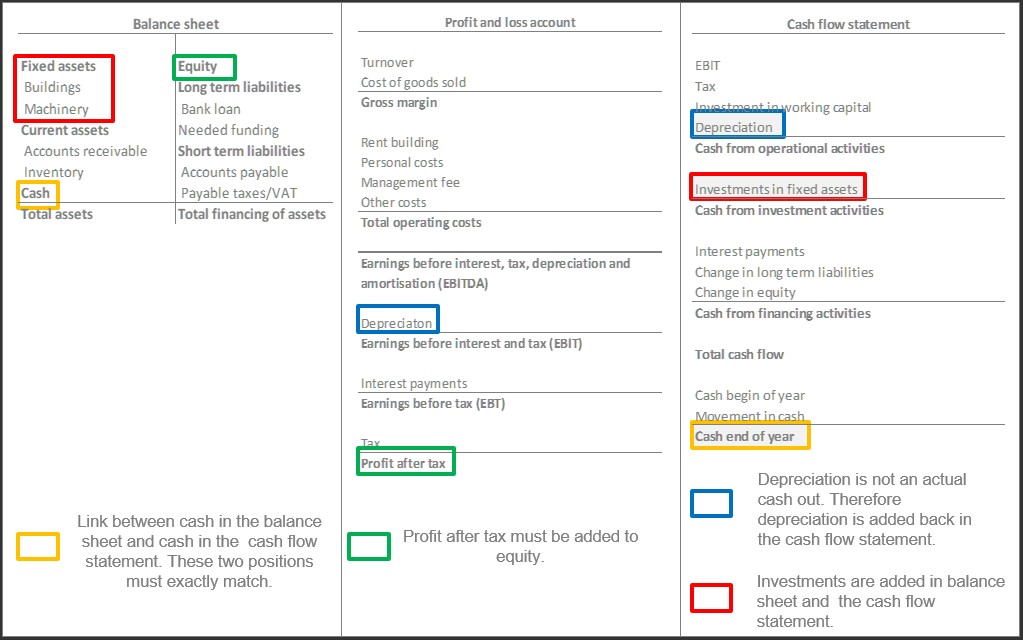

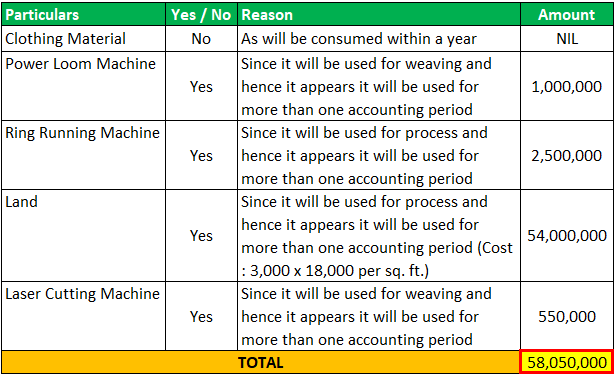

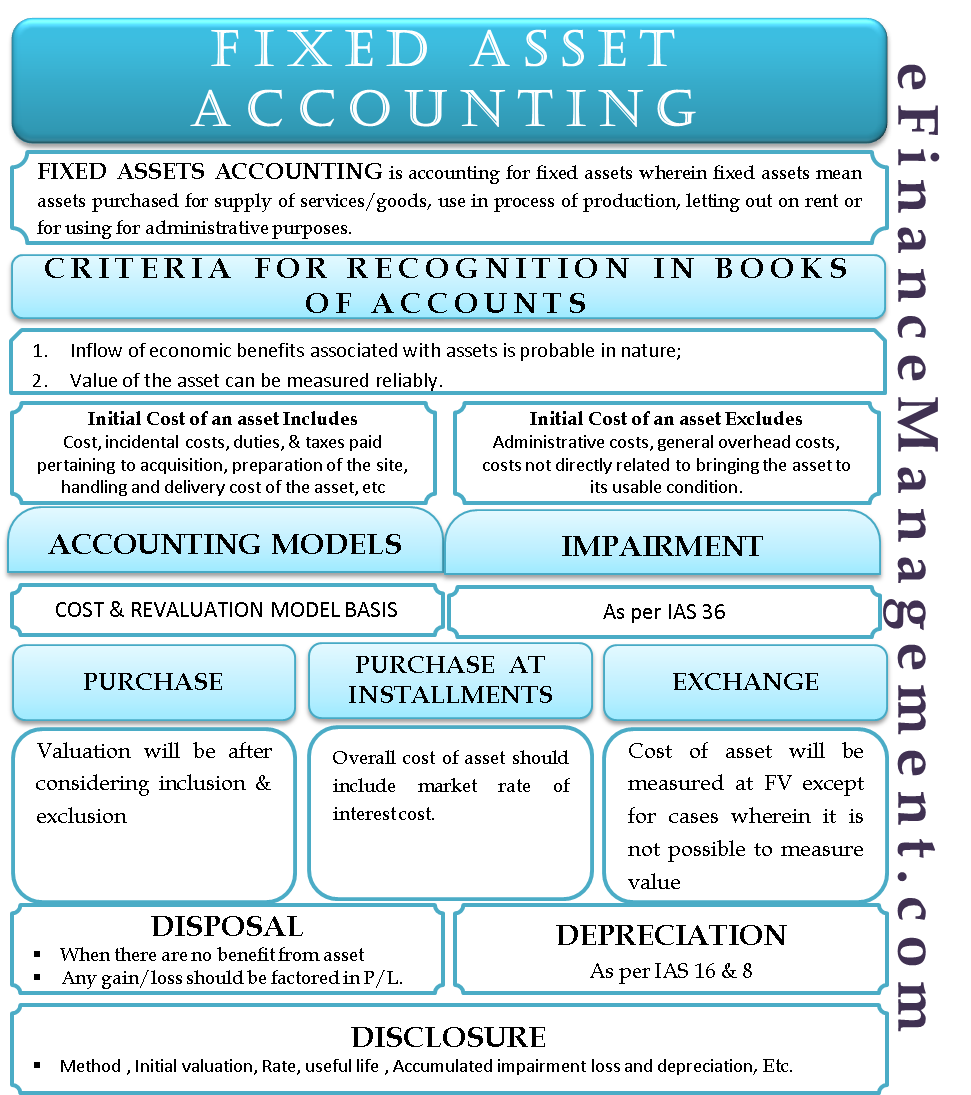

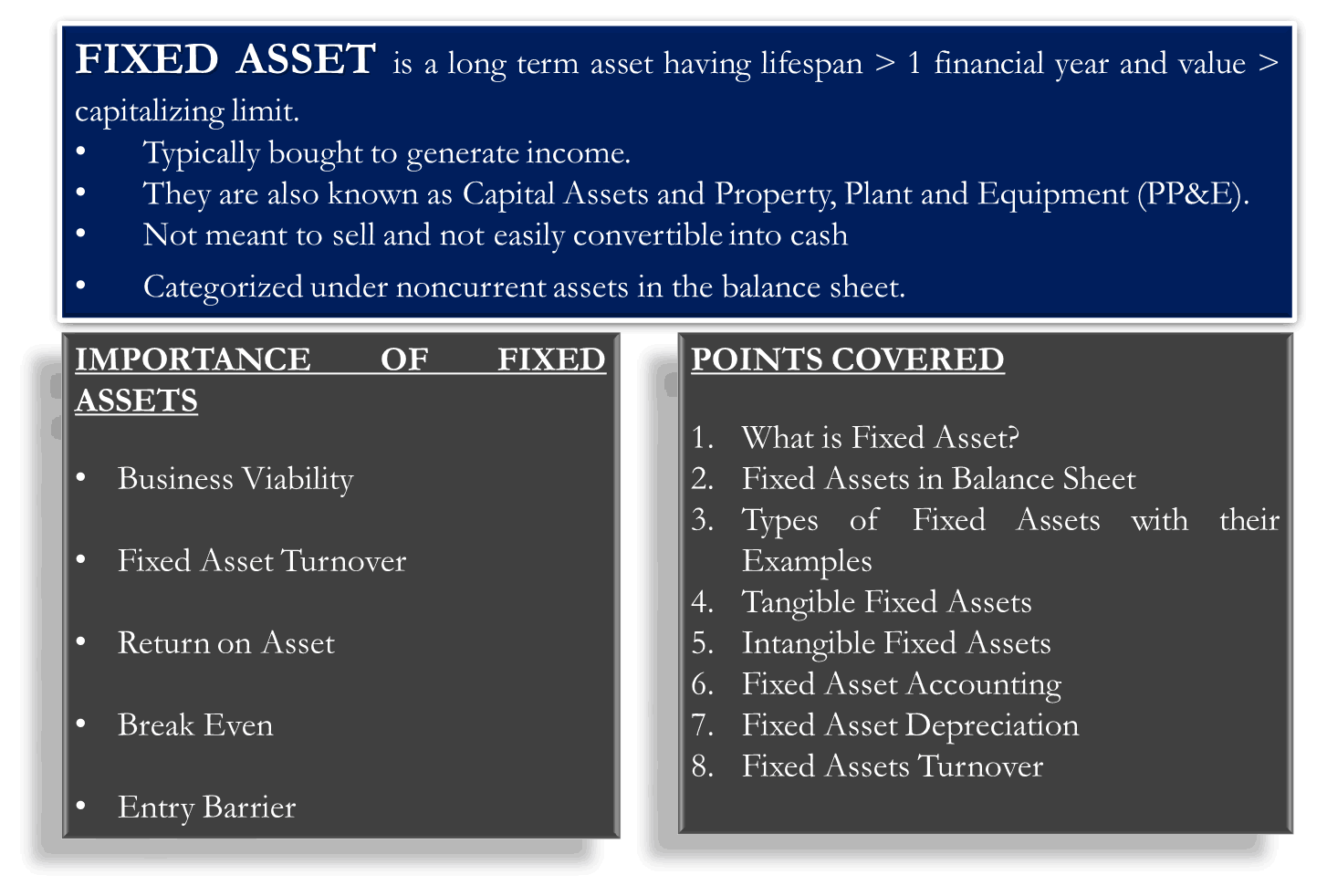

IAS 38 outlines the accounting requirements for intangible assets, which are nonmonetary assets which are without physical substance and identifiable (either being separable or arising from contractual or other legal rights) Intangible assets meeting the relevant recognition criteria are initially measured at cost, subsequently measured at cost or using the revaluation model, and amortised. Capital expenditures recorded to current fund must use object code 9700 At the end of each fiscal year, a listing of object code 9700 expenditures will be prepared and reviewed by Capital Asset Accounting for proper classification Refer to attachment A for cost examples that are capitalized as building improvements or expensed. These assets are expected to be used for more than one accounting period Fixed assets are generally not considered to be a liquid form of assets unlike current assets Examples of common types of fixed assets include buildings, land, furniture and fixtures, machines and vehicles.

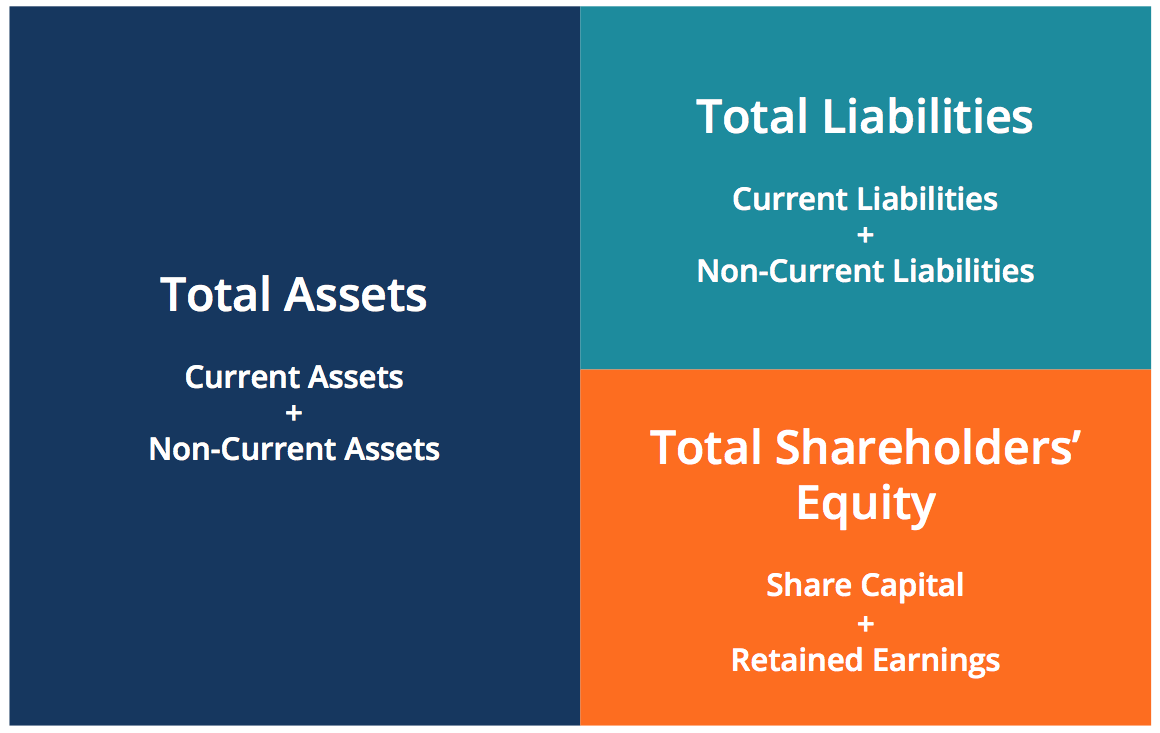

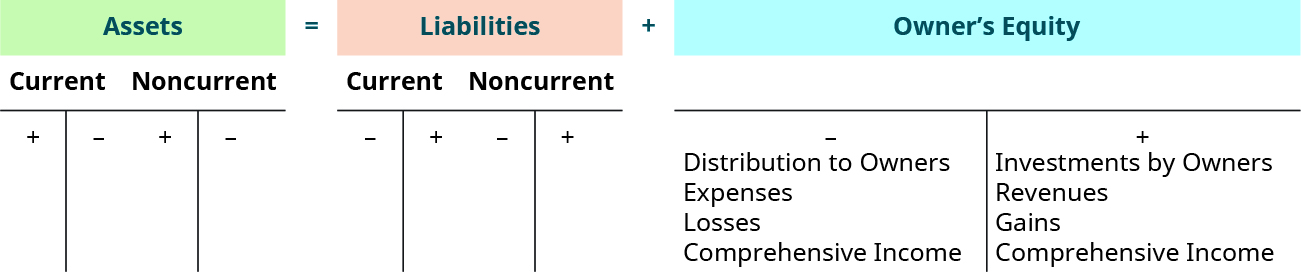

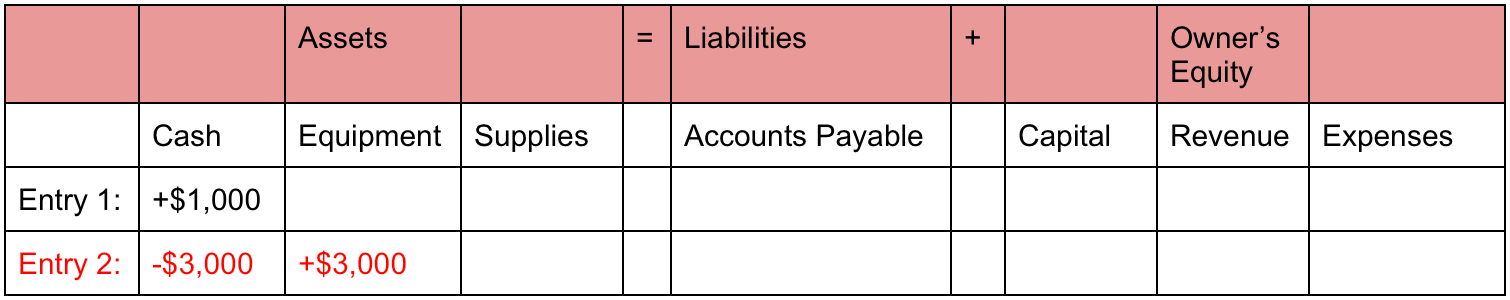

Common examples of contra assets include Accumulated depreciation Accumulated Depreciation Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use It is a contraasset account – a negative asset account that offsets the balance in the asset account it is normally. Example 3 – Contract Asset Resulting from a Contract with Multiple Performance Obligations On January 1, 19, an entity enters into a contract to transfer Product 1 and perform Service 1 to a customer for a total consideration of $750 (IL) We provide a variety of audit, tax, accounting, and consulting services to help high net worth. Asset = liabilities equity is the basic accounting equation and the main element of the doubleentry accounting system The doubleentry system records transactions as debits and credits Given the fact that each debit offsets a credit, the sum of all debits needs to be equal to the sum of all credits in any accurate doubleentry system.

Hence all these assets are not included while computing fixed assets Example #2 – Fixed Asset Account Hydra Inc purchased a machine during January 16 worth $15 million (trade discount = $150,000) and incurred $50,000 for transportation and installation. Assets are divided into various categories for the purposes of accounting, taxation and to measure the value or financial health of an entity 5 Types of Asset » 10 Examples of Asset Tracking ». It is important to note that this asset is classified as an intangible asset, rather than a fixed asset, on the lessee’s books Lessee vs lessor accounting New lease standards have been released over the last few years , impacting companies that comply with United States, international, and governmental accounting standards.

A Current assets – Assets are considered current if they are held for the purpose of being traded, expected to be realized or consumed within twelve months after the end of the period or its normal operating cycle (whichever is longer), or if it is cash Examples of current asset accounts are. In accounting, assets are what a company owes while liabilities are what a company owns, according to the Houston Chronicle In other words, assets are items that benefit a company economically, such as inventory, buildings, equipment and cash They help a business manufacture goods or provide services, now and in the future. An asset is a resource owned or controlled by an individual, corporation, or government with the expectation that it will generate a positive economic value Common types of assets include current, noncurrent, physical, intangible, operating, and nonoperating.

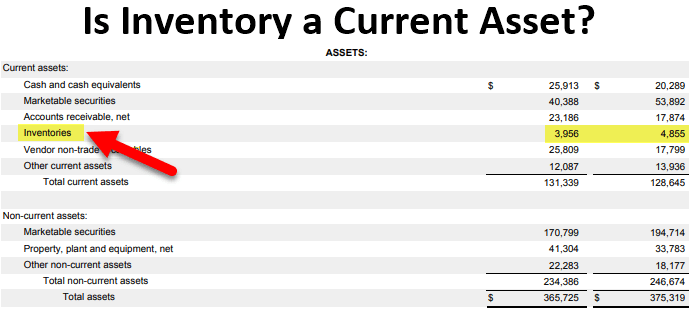

It is important to note that this asset is classified as an intangible asset, rather than a fixed asset, on the lessee’s books Lessee vs lessor accounting New lease standards have been released over the last few years , impacting companies that comply with United States, international, and governmental accounting standards. Inventory is a noncurrent asset;. Assets and Liabilities Examples;.

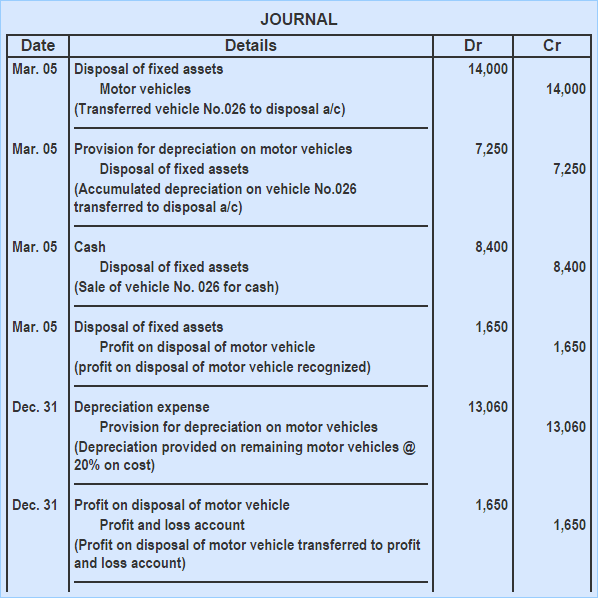

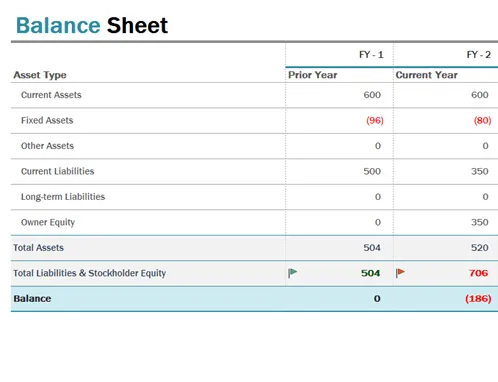

Current Assets Definition In accounting terms, any asset expected to the sold for cash or cash equivalent value within a period of one year or within accounting cycle is known as “Current Asset” Examples of current asset include Cash, debt claims, stock, account receivable, inventory, prepaid expenses, shortterm investments and other liquid asset that can be converted to cash. Businesses depreciate noncurrent assets for accounting purposes For example, a business purchasing a new machine would initially record this in its balance sheet as an asset Instead of realizing the entire cost of the asset in year one through the income statement, depreciating the asset allows the business to spread out that cost and. Fixed assets may be sold anytime during their useful life This gives rise to the need to derecognize the asset from balance sheet and recognize any resulting gain or loss in the income statement The accounting for disposal of fixed assets can be summarized as follows Record cash receive or the receivable created from the sale.

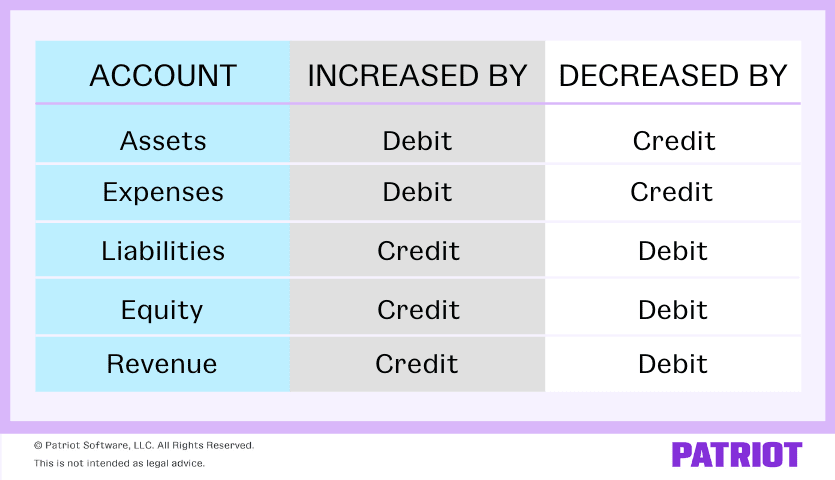

A debit is always used to increase the balance of an asset account, and the cash account is an asset account Since we deposited funds in the amount of $250, we increased the balance in the cash. Generally, the asset account balances are debit balances and are increased with a debit entry and decreased with a credit entry Examples of Asset Accounts Some examples of asset accounts include Cash, Accounts Receivable, Inventory, Prepaid Expenses, Investments, Buildings, Equipment, Vehicles, Goodwill, and many more. Examples of Assets include Property, Plant and Equipment, Vehicles, Cash and Cash Equivalents, Accounts Receivables, and Inventory Following are the characteristics of assets It is owned and controlled by the enterprise It provides a probable future economic benefit Types of Assets in Accounting Assets can be of 2 types Current Assets.

Example 2 Burrowed cash from Bank Cash – Debit (Increase. Since an asset devaluation is a noncash event, there is no associated outflow of cash To solidify your understanding of the impact of a stranded asset, let us walk through an example Example A company reports under US GAAP and is an operator of oil platforms. Fixed Asset Accountant Resume Examples Fixed Asset Accountants manage detailed financial records on the fixed assets owned by a business Example resumes of Fixed Asset Accountants include such skills as monitoring and tracking capital purchases for timely asset capitalization, recording asset acquisitions and disposals, and maintaining internal and tax books for fixed assets.

Assets are divided into various categories for the purposes of accounting, taxation and to measure the value or financial health of an entity 5 Types of Asset » 10 Examples of Asset Tracking ». Asset = liabilities equity is the basic accounting equation and the main element of the doubleentry accounting system The doubleentry system records transactions as debits and credits Given the fact that each debit offsets a credit, the sum of all debits needs to be equal to the sum of all credits in any accurate doubleentry system. Since an asset devaluation is a noncash event, there is no associated outflow of cash To solidify your understanding of the impact of a stranded asset, let us walk through an example Example A company reports under US GAAP and is an operator of oil platforms.

Examples of individual assets include Property/Homes Jewelry/Collectibles Cash and cash equivalents Certificate of Deposit ( CDs) Investments including bonds, mutual funds, and retirement plans. In accounting, assets are what a company owes while liabilities are what a company owns, according to the Houston Chronicle In other words, assets are items that benefit a company economically, such as inventory, buildings, equipment and cash. Assets are divided into various categories for the purposes of accounting, taxation and to measure the value or financial health of an entity 5 Types of Asset » 10 Examples of Asset Tracking ».

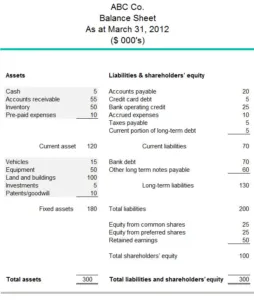

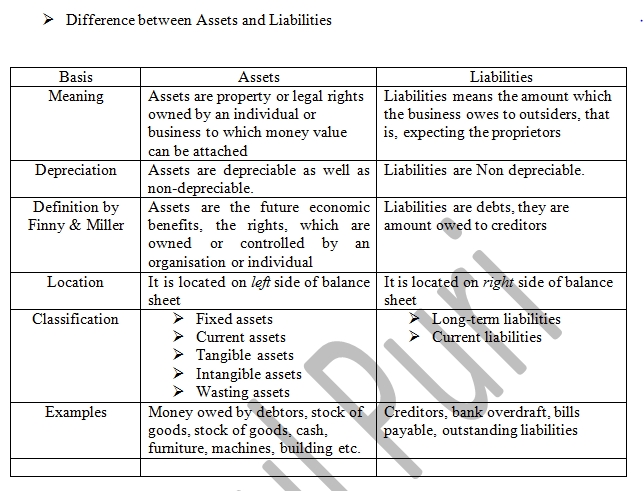

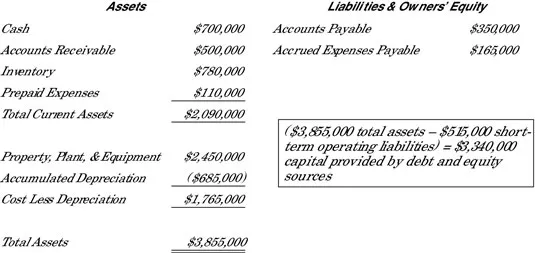

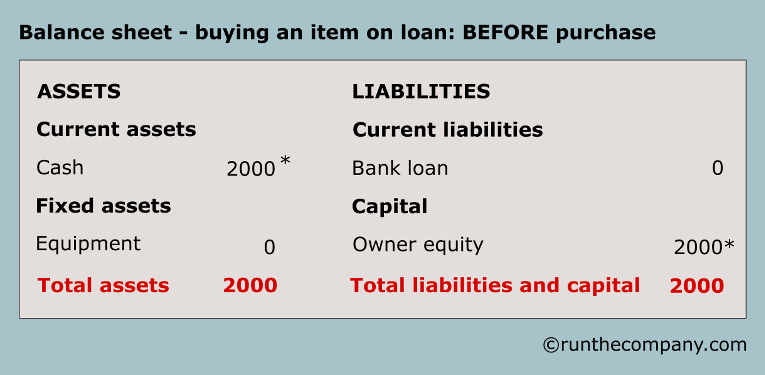

What Is the Difference Between Assets and Liabilities?. For example, if a company has $900,000 of current assets and has $400,000 of current liabilities, its working capital is $500,000 If a company has $900,000 of current assets and has $900,000 of current liabilities, it has no working capital Other people use the term working capital ratio to mean the current ratio, which is defined as the amount of current assets divided by the amount of. Fixedasset accounting is about distinguishing between what costs can be capitalized and what should be immediately expensed in the year the asset goes into service,” Adams adds Accounting regulations and standards are followed to ensure the uniformity of an organization’s financial statements.

The Company writes a check for $8,500 of equipment Analysis Since a check was written, QuickBooks will automatically credit CashThe item is too costly to be considered an expense, so it must be entered into the accounting system as an assetSo we will debit an Asset account called Equipment or something similar. Assets and Liabilities Examples;. An asset is an economic resource that can be owned by an individual, company, or country Assets are expected to provide future economic benefits like Increased value for a company or country Increased net worth for an individual Assets accomplish this by providing cash flow, reducing expenses, and/or increasing sales Examples of Company Assets.

Example of Asset Disposal For example, ABC International buys a machine for $50,000 and recognizes $5,000 of depreciation per year over the following ten years At that time, the machine is fully depreciated, ABC gives it away, and records the following entry. What Is the Difference Between Assets and Liabilities?. Asset retirement obligation accounting example with journal entries Have you ever entered into an operating lease for a building, constructed leasehold improvements, and determined based on the provisions of the lease that you are legally obligated to remove the leasehold improvements at the end of the lease?.

An asset like kitchen equipment is one which we plan to use over a number of years Did you know that a longterm asset, like this kitchen equipment, has a specific name?. Examples of assets that are found on the balance sheet are as follows (presented in alphabetical order) Bond investments Building fixed assets Cash Certificate of deposit investments Commercial paper investments Computer equipment fixed assets Computer software fixed assets Finished goods inventory. Asset = liabilities equity is the basic accounting equation and the main element of the doubleentry accounting system The doubleentry system records transactions as debits and credits Given the fact that each debit offsets a credit, the sum of all debits needs to be equal to the sum of all credits in any accurate doubleentry system.

Example of Most Common Assets in Accounting #1 – Current Assets (Short Term in Nature) Cash It includes the bank balance and cash available in the business #2 – Capital Assets (Long Term in Nature) Property, Plant & Equipment It includes all the properties/offices, #3 – Intangible Assets. Assets $30,000 in cash = Liabilities $0 Equity $30,000 in stock (you and Anne) Now let’s say you spend $4,000 of your company’s cash on MacBooks For the accounting equation to remain in balance, we need to not only decrease the cash account by $4,000, but also increase the equipment account by $4,000 Assets $26,000 in cash. This item includes all goods intended to be used in a sustainable way for the company’s business In accounting language, these are “fixed assets” There are three types The intangible assets these are a nonmonetary asset without physical substance These include, for example, patents, software, goodwill, setup costs.

Fixedasset accounting is about distinguishing between what costs can be capitalized and what should be immediately expensed in the year the asset goes into service,” Adams adds Accounting regulations and standards are followed to ensure the uniformity of an organization’s financial statements. For example, if a company has $900,000 of current assets and has $400,000 of current liabilities, its working capital is $500,000 If a company has $900,000 of current assets and has $900,000 of current liabilities, it has no working capital Other people use the term working capital ratio to mean the current ratio, which is defined as the amount of current assets divided by the amount of. Tangible assets include any resources with a physical presence Some examples include cash, fixed assets, and equipment Some of these resources are depreciated while others are not Intangible assets are resources that don’t have a physical presence.

In accounting, assets are what a company owes while liabilities are what a company owns, according to the Houston Chronicle In other words, assets are items that benefit a company economically, such as inventory, buildings, equipment and cash. Accounting estimates require judgement pertaining to future benefits that can possibly be derived from the assets, and obligations which are likely to incur as a factor of those liabilities Furthermore, they are mainly based on the information which reflects the situations and circumstances that exist at the date of the estimation. Cash – Cash is the most liquid asset a company can own It includes any form of currency that can be readily traded including coins, checks, money orders, and bank account balances Accounts Receivable – Accounts Receivable is an asset that arises from selling goods or services to someone on credit.

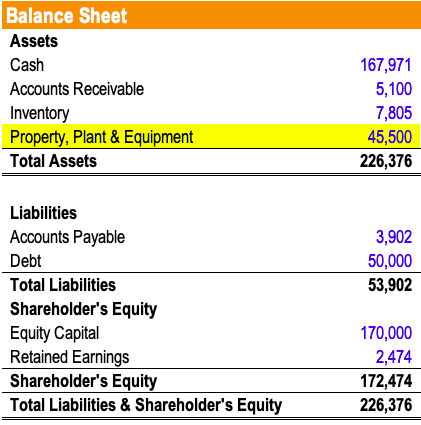

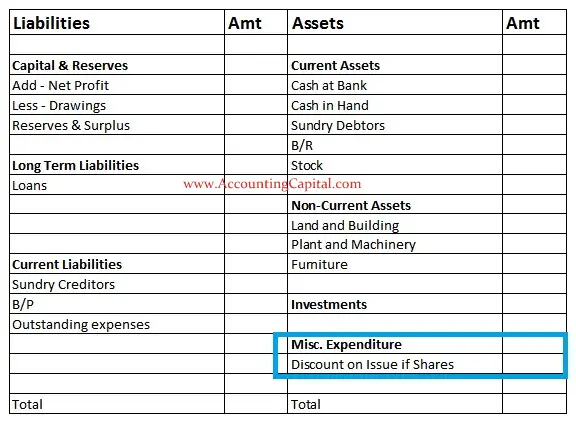

Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles Assets are reported on the balance sheet usually at cost or lower Assets are also part of the accounting equation Assets = Liabilities Owner's (Stockholders') Equity. The Company writes a check for $8,500 of equipment Analysis Since a check was written, QuickBooks will automatically credit CashThe item is too costly to be considered an expense, so it must be entered into the accounting system as an assetSo we will debit an Asset account called Equipment or something similar. Since an asset devaluation is a noncash event, there is no associated outflow of cash To solidify your understanding of the impact of a stranded asset, let us walk through an example Example A company reports under US GAAP and is an operator of oil platforms.

They are generally referred to as property, plant, and equipment (PP&E) and are referred to as Capital assets Now let us understand examples of Fixed Assets as well as Fixed Asset Accounting Examples of Fixed Assets Machinery;. Accounting Rules for Debit & Credit Below are examples of debit and credit accounting transactions Note the transactions are viewed from the side of Tutorial Kart Example 1 Tutorial Kart started business with cash Cash – Debit (Increase in Asset) Capital Account – Credit;. Asset Category Useful Life Equipment 5 or 10 Years, Depending on Asset Buildings 50 Years Infrastructure Improvements 25 or 75 Years Facilities & Other Improvements Years Software Developed or Obtained for Internal Use 10 Years Land Not Depreciated Library Books 10 Years Capitalized Collections Not Depreciated.

It's known as a fixed asset or a noncurrent asset. Assets are economic resources controlled by a business which can potentially benefit its operations or are convertible to cash (cash itself is also an asset) Examples of Assets Following are the common assets of a business Cash Cash includes physical money such as bank notes and coins as well as amount deposited in bank for current use. The fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets In each case the fixed assets journal entries show the debit and credit account together with a brief narrative.

Fixed assets are longterm tangible pieces of property Companies use these assets in their daily business operations to generate an income Often referred to as the ‘capital’ of the business, fixed assets include items such as machinery and plant equipment.

Fixed Asset Accounting Made Simple Netsuite

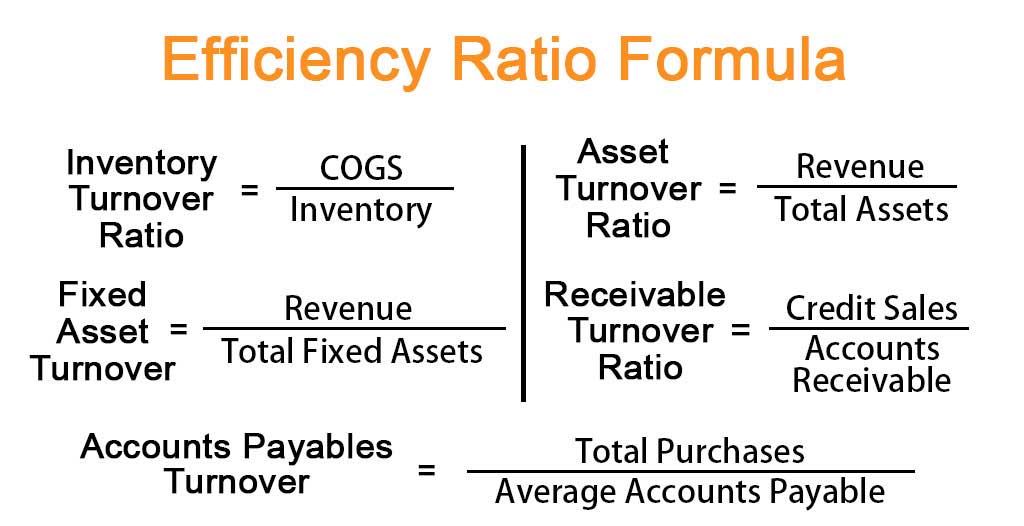

Efficiency Ratio Formula Examples With Excel Template

What Are Current Assets Definition Meaning List Examples Formula Types

Asset In Accounting Examples のギャラリー

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Fictitious Assets Meaning And Explanation Tutor S Tips

Nature Of Fixed Assets Course Hero

What Is Contra Account And Its Importance Tally Solutions

Fixed Asset Purchase With Cash Double Entry Bookkeeping

Current Assets List Of Current Assets With Examples Youtube

What Is An Intangible Asset A Simple Definition For Small Business With Examples

Chapter 9 2 Double Entry Accounting Accounting Debits Credits

Double Entry Bookkeeping Principle Explanation And Examples

Double Entry System Of Accounting Docsity

What Is Inventory

What Are Current Assets Definition Example List How To Calculate

Accounting Equation Overview Formula And Examples

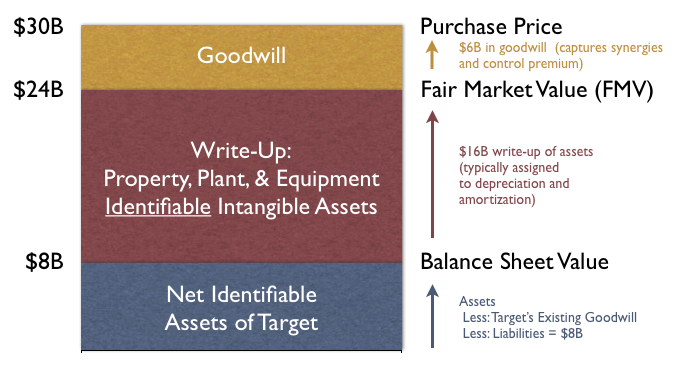

Purchase Price Allocation Wikipedia

3

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

Property Plant And Equipment Pp E Definition

Is Inventories A Current Asset Full Explanation With Examples

Statement Of Financial Position Format Components Analysis Example

The Basics Of Accounting Boundless Accounting

Current Assets Definition Examples Full List Of Items Included

Tangible Vs Intangible Assets What S The Difference

Accounting 101 Assets

1

Adjusting Entries For Asset Accounts Accountingcoach

Fixed Assets Definition Characteristics Examples

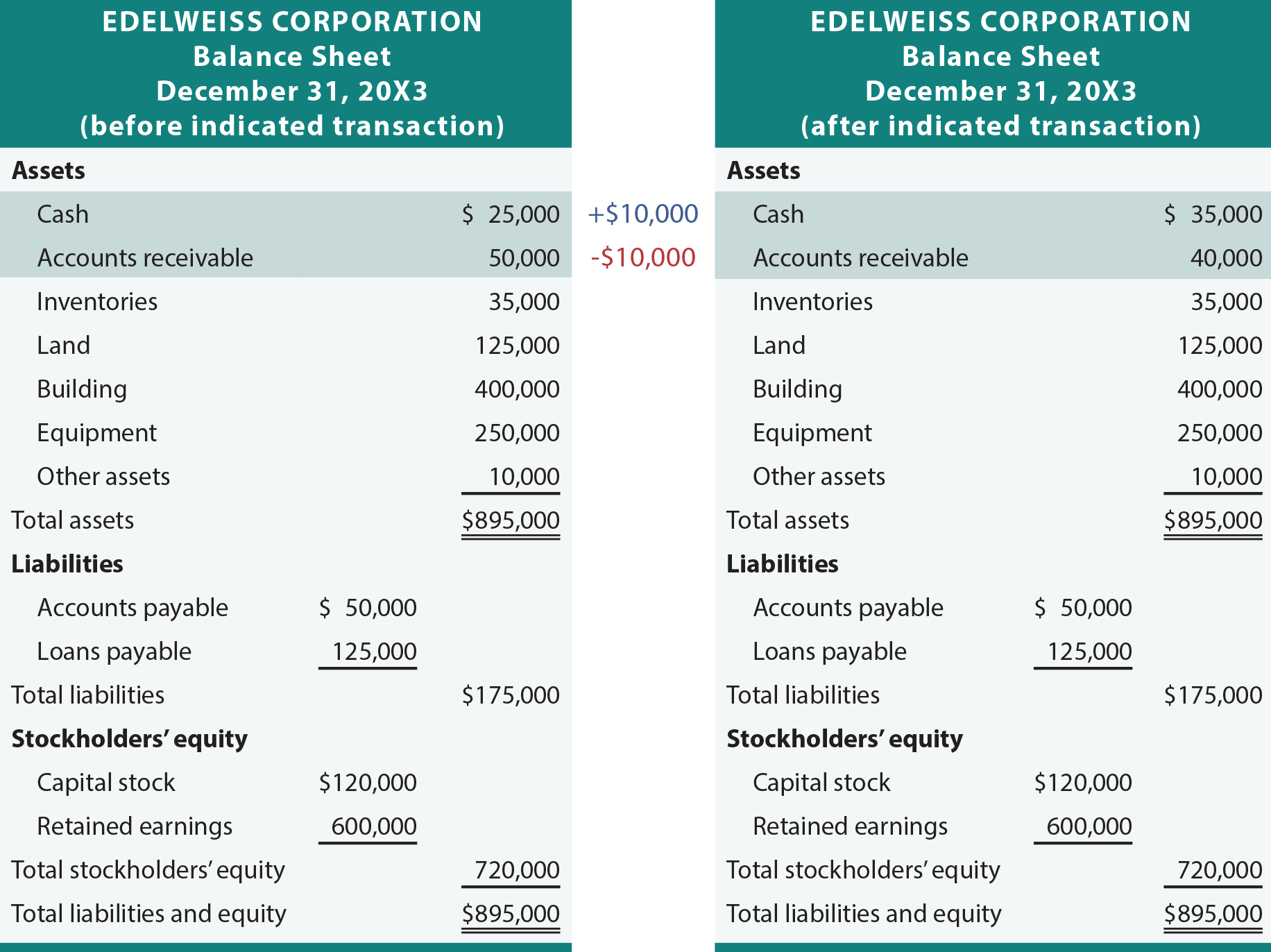

How Transactions Impact The Accounting Equation Principlesofaccounting Com

Assets Liabilities And Equity Quickeasy Bos Business Software For Sme S

List Of Assets List Of Top 10 Balance Sheet Assets

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

What Are Assets And Liabilities A Simple Primer For Small Businesses

Sap Asset Accounting Configuration Steps As A Subledger

Contra Asset Examples How A Contra Asset Account Works

What Is A Fixed Asset Definition Types Formula Examples List

Financial Statements Overview Objectives Double Entry Accounting

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

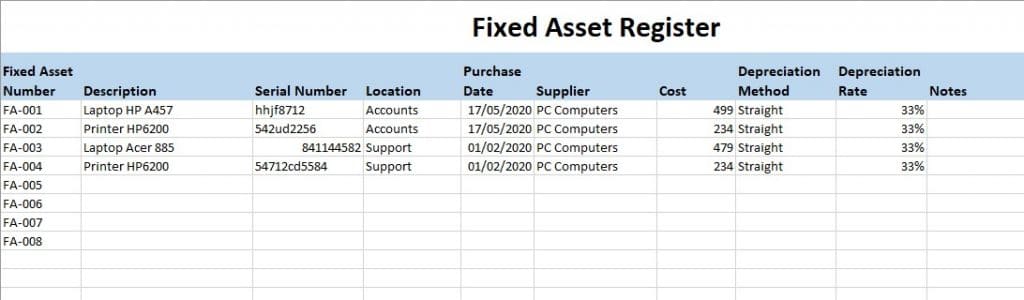

Fixed Asset Register Track Fixed Assets Free Template

Types Of Accounts In Accounting Assets Expenses Liabilities More

B S And Income Statement S Item With Accounting Guidance Facebook

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Intangible Assets Financial Accounting

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

Property Plant And Equipment Pp E Definition

Intangible Assets Meaning Valuation Categories Example Accounting

Accounting Equation Explained Definition Examples

Current Assets Examples Accounting Education

How Do Intangible Assets Show On A Balance Sheet

Depreciation And Disposal Of Fixed Assets Examples Play Accounting

Total Assets Definition Explanation Video Lesson Transcript Study Com

Balance Sheet Definition Examples Assets Liabilities Equity

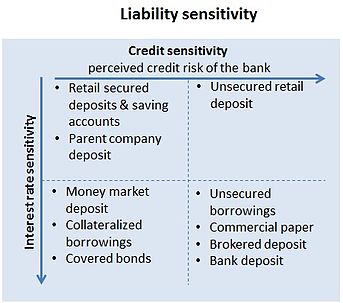

Asset And Liability Management Wikipedia

Contra Asset Account Definition List Examples With Accounting Entry

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Plant Assets What Are They And How Do You Manage Them The Blueprint

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Current Assets Business Tutor2u

Difference Between Tangible And Intangible Assets With Examples

Current Assets Meaning Examples Quiz Accountingcapital

Quiz Worksheet Non Current Assets In Accounting Study Com

The Ultimate Guide To Financial Modeling For Startups Ey Netherlands

Does The Balance Sheet Always Balance

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Right Of Use Rou Asset Lease Liability Asc 842 Ifrs 16

Accounting Equation Explained Definition Examples

Financial Assets Examples Accounting Education

Quick Assets Overview How To Calculate Example

Examples Of Assets In Accounting Top 12 Balance Sheet Assets

Asset Accounting

Statement Of Financial Position Nonprofit Accounting Basics

Types Of Assets In Accounting Top 3 Types With Examples

What Is A Contra Asset Account Double Entry Bookkeeping

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

Fixed Assets In Accounting Definition List Top Examples

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Fixed Assets In Accounting Definition List Top Examples

Fictitious Assets Meaning Examples Quiz Accountingcapital

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

What Is A Financial Instrument Acca Qualification Students Acca Global

Q Tbn And9gct7i2xmciw5ftvktfmoudk8 Ewcvgp035uraasncdmezclyreh1 Usqp Cau

Sample Chart Of Accounts For A Small Company Accountingcoach

How To Calculate Assets A Step By Step Guide For Small Businesses

Balance Sheet Examples Runthecompany

Fixed Asset Accounting With Equipment Status And Location Powerpoint Templates Designs Ppt Slide Examples Presentation Outline

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Long Term Assets Definition

What Is A Balance Sheet Accountingcoach

Fixed Asset Accounting Overview And Best Practices Involved

Current Assets Definition Examples Full List Of Items Included

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Fixed Assets Purchase Incurring A Liability Double Entry Bookkeeping

Fixed Asset Trade In Double Entry Bookkeeping

Types Of Assets List Of Asset Classification On The Balance Sheet

Oracle Public Sector Financials User Guide

Plant Assets Definition Types Examples Depreciation Of Plant Assets

What Is A Fixed Asset Definition And Example Goselfemployed Co Fixed Asset Finance Blog Asset

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Balance Sheet Examples Runthecompany

Asset Manager Cv Template And Examples Renaix Com

Meaning And Different Types Of Assets Classification More

Balance Sheet Definition Examples Assets Liabilities Equity

What Are Intangible Assets Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

What Are Fixed Assets Type Tangible Intangible Accounting Dep