Family Trust

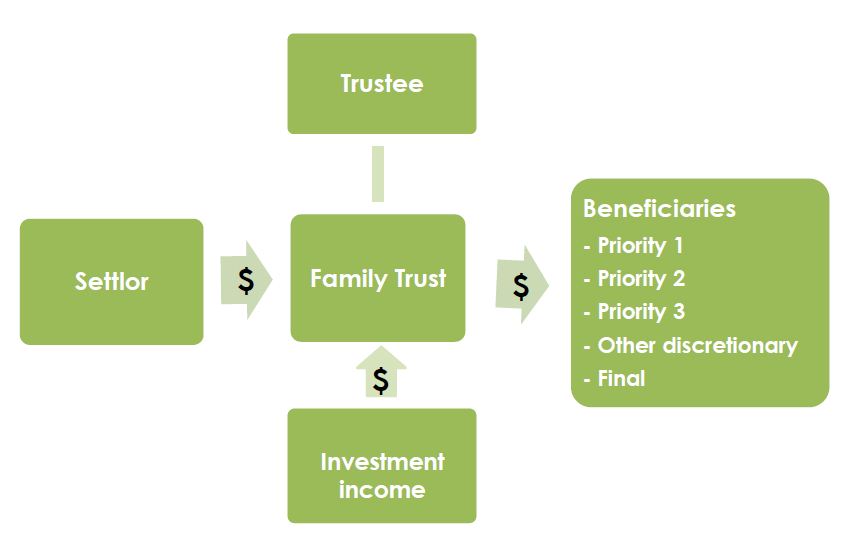

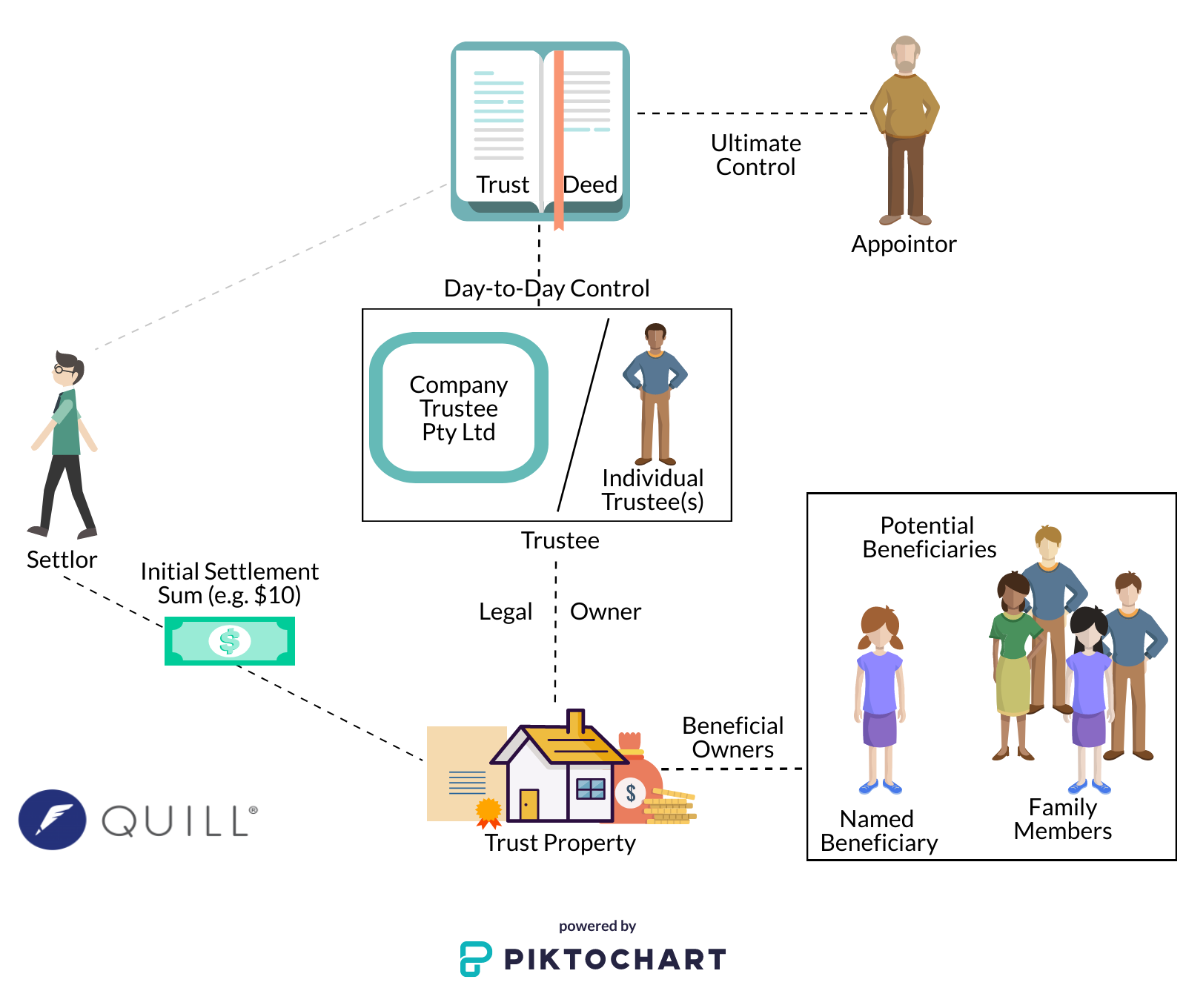

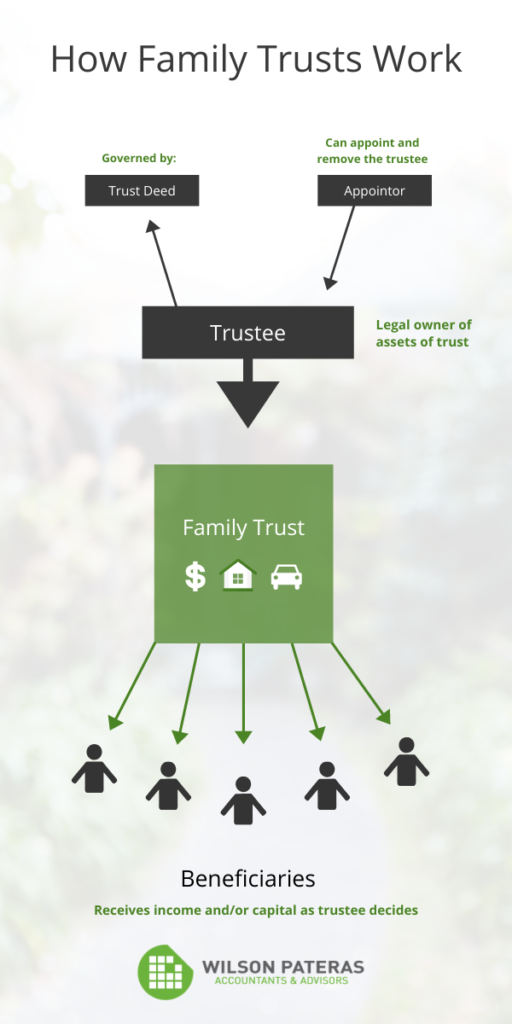

The family trust allows you to protect and pass on assets such as the family home, the family business or business interests, bank accounts, investment accounts, collections, personal property and other valuables The person or persons creating the family trust and placing items within the trust are the trustors.

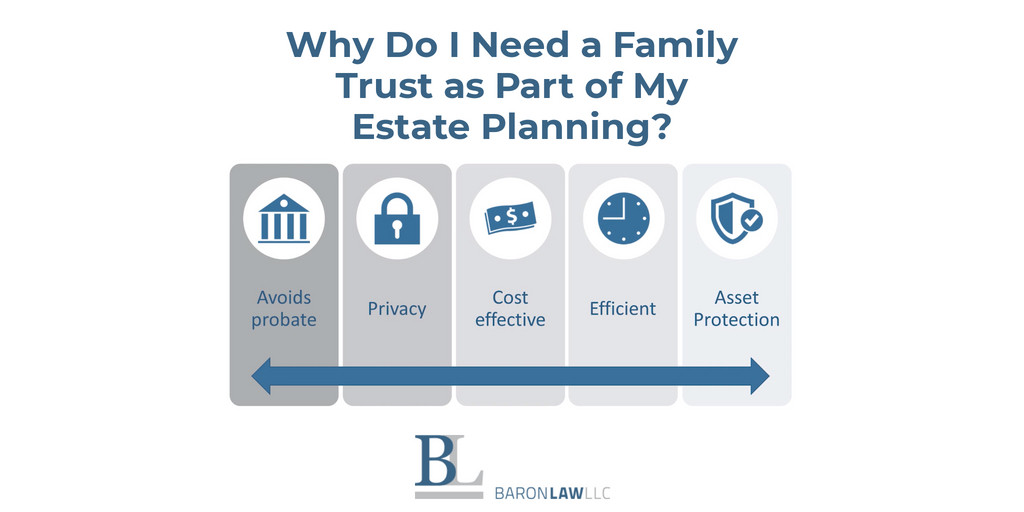

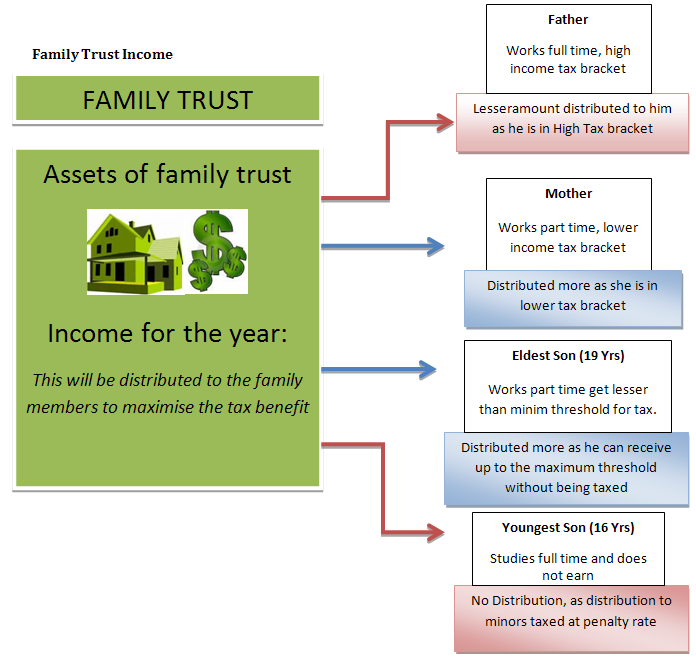

Family trust. Where family trusts are utilized, and amounts are payable to children The amounts must be used for the benefit of the children Any amounts paid to the children will reduce the amount owing to them The amounts received by the children from the family trust could be used to pay certain expenses, which would otherwise have been paid by the parents. A family trust is a legal document that gives a trustee, often a family member, the legal authority to make decisions about the distribution of income, property or other assets to identified family members Often, a family member establishes a family trust to protect assets, create tax advantages and avoid probate. Family Trust FCU is here to help you achieve all of your financial goals, whether you are looking to buy a house or planning for retirement or saving to send your new baby to college We’re also here to make the daily ins and outs of managing your money easier and more convenient.

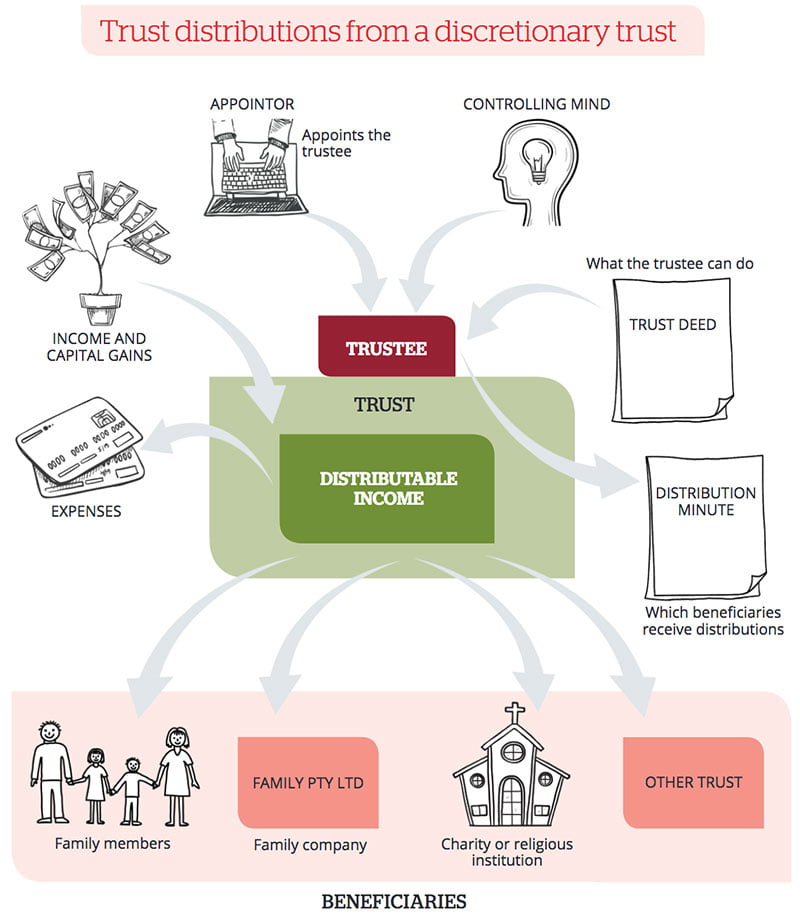

A trust is a legal entity set up to manage assets on someone's behalf A living trust is a trust set up while the person is still alive, sometimes with the ability to modify the arrangement A family trust is essentially any trust set up for the benefit of someone's relatives. A family trust can be either a living trust or a testamentary trust, depending upon the grantor’s objectives A living family trust might involve a married couple serving as cotrustees of a trust that holds title to their home until both have passed on, at which point a successor trustee transfers title to their children outside of probate. A family trust is an agreement where a person or a company agrees to hold assets for others’ benefit, usually their family members It is often set up by families to own assets A family trust is also referred to as a “discretionary” trust The word “discretionary” refers to the trustee’s powers or ability to decide which.

A family trust is a trust established specifically for the benefit of members of a particular family The purpose of creating a family trust is to protect and manage family assets for current and / or future generations. 1 Trust is a separate Legal person hence tax planning tool 2 An individual can control use of his wealth even after death via Trust deed rules for few years when kids or family are yet to be matured enough to manage wealth or business empire. Learn the basics about trusts and how they are used in estate planning What is a trust?.

An irrevocable family trust avoids estate taxes by paying the gift taxes on property at the time of deposit into the trust Gift taxes are usually lower than estate taxes Limitations There are some limitations to a family trust When you transfer your ownership of the assets to the trust, you will no longer have control over them. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries Trusts can be arranged in may ways and can specify exactly how and when the assets pass to the beneficiaries Learn more about trusts and how they can help you in estate planning. The Family Court has wide powers to decide what can be divided, and generally the court included assets in the discretionary trust to be divided, where a spouse is a trustee, or has the means to.

A family trust is essentially airtight legally, another potential advantage over a simple will Limitation of exposure to estate taxes, as part of a proper estate planning process Simplicity and Flexibility A family trust is a relatively easy document to prepare and account for, particularly with the help of an estate planning attorney. Family foundations are a type of private foundation offering certain tax benefits and flexible giving options, and are generally governed, administered and funded by a family unit See if a private family foundation is the best fit for your family’s philanthropic goals and how it compares with other giving vehicles. A family trust is a legal entity Once you create it, you transfer your assets into it, so that the trust owns your property instead of you You set up the trust by defining the "beneficiaries," which are people that will someday get things from it, and the "trustee," who is in control of the trust.

Family trusts are a common type of trust used to hold assets or run a family business A family trust is an inter vivos discretionary trust which means it is established by someone during their lifetime to manage certain assets or investments and support beneficiaries, such as family members There are certain advantages and disadvantages of family trusts, for example, if you are holding. Overview Trusts are essentially creatures of contract Virtually all trusts are made in written form, either through an inter vivos or "living trust" instrument (created while the settlor is living) or in a will (which creates a testamentary trust)Therefore, in understanding certain terms in a trust, general rules of construction regarding interpretation of wills or other testamentary. A Family Trust Deed provides the flexibility, control and protection that you need, to give significant gifts in your lifetime with complete peace of mind The deed of family trust lays down the terms and conditions of the trust and provides for the mechanism for the functioning of the same.

Family Trusts explained and Family Trust Elections explained The term family trust refers to a discretionary trust set up to hold a family's assets or to conduct a family business Generally, they are established for asset protection or tax purposes The importance of Family Trust Elections are explained below under the heading "Family trust elections — a word from the ATO on income. Alabama Family Trust is a nonprofit, 501(c) 3, pooled trust company administering special needs trusts for the disabled throughout the United States Disabled individuals, including the elderly entering nursing homes, can place assets from legal settlements, inheritance, gifts, alimony, and other forms of assets with Alabama Family Trust and. Family Trust vs Living Trust Quite simply, a “family trust" may refer to any trust created with family members as its beneficiaries A family trust can be set up in two ways Testamentary Trust Set up through a last will and testament, which means it will only come into existence upon the death of the grantor and probating of the will A.

A trust is a legal entity that you can put your money and assets into so that you can then pass it on to one or multiple beneficiaries, typically after your death A family trust is any type of trust that you use to pass on assets to one or multiple family members Anytime you talk about trusts, there are a few terms to make sure you understand. The marital trust is a revocable trust that belongs to the surviving spouse A revocable trust has terms that can be changed by the person who established the trust The family or B trust is irrevocable, meaning its terms cannot be changed When the first spouse passes away, their share of the estate goes into the family or B trust. Family Trust Sam Smith has agreed to be the initial trustee of the trust The trustee is to act in accordance with this deed The trust is to commence on the day this deed is executed as specified in the Schedule and is to end on the ‘vesting day’ Beneficiaries of the trust 2 The beneficiaries of the trust are.

With Family Trust mobile banking, it’s more convenient than ever to access your Family Trust accounts on your iPhone or iPad The app allows you to transfer money between your Family Trust accounts and other financial institutions, make loan payments, find branches and surchargefree ATMs, and deposit checks. A family trust, also known as a living trust or revocable living trust, is a legal document that permits the person who prepares it or has it prepared to make changes to it at willThis type of trust covers how a person’s assets are handled before and after death These provisions can include anything from beneficiaries to property and cash allocations. Family Trust Federal Credit Union, Rock Hill 5,198 likes · 21 talking about this · 377 were here Family Trust represents over 50,000 members and has 7 locations in York County We've been serving.

Family Trusts explained and Family Trust Elections explained The term family trust refers to a discretionary trust set up to hold a family's assets or to conduct a family business Generally, they are established for asset protection or tax purposes The importance of Family Trust Elections are explained below under the heading "Family trust elections — a word from the ATO on income. Family foundations are a type of private foundation offering certain tax benefits and flexible giving options, and are generally governed, administered and funded by a family unit See if a private family foundation is the best fit for your family’s philanthropic goals and how it compares with other giving vehicles. A family trust is an agreement where a person or a company agrees to hold assets for others’ benefit, usually their family members It is often set up by families to own assets A family trust is also referred to as a “discretionary” trust The word “discretionary” refers to the trustee’s powers or ability to decide which.

A family trust is also known as a revocable living trust The family or living trust is a simple yet extremely powerful too One of the most important benefits is that it can help you avoid probate (if set up correctly) But it does much more than just that. A trust is a legal document that can be created during a person's lifetime and survive the person's death A trust can also be created by a will and formed after death Common types of trusts are outlined in this article Once assets are put into the trust they belong to the trust itself (such as a bank account), not the trustee (person) They remain subject to the rules and instructions of. What type of trust do you need?.

The Family Court has wide powers to decide what can be divided, and generally the court included assets in the discretionary trust to be divided, where a spouse is a trustee, or has the means to. A revocable family trust is a trust that is set up for the purposes of protecting assets and providing for your family members Trusts can be used to achieve many asset protection and estate planning goals and can be a powerful legal tool for those who want to protect their loved ones and legacy. 1 Trust is a separate Legal person hence tax planning tool 2 An individual can control use of his wealth even after death via Trust deed rules for few years when kids or family are yet to be matured enough to manage wealth or business empire.

A family trust is a way to structure finances that removes them from individual ownership and tax liability It places assets in the care of a third party, who manages the trust on behalf of its. Watch and learn hereNOTE NOT LEGAL. Family Trust has been compared to The Nest but I enjoyed it more, found the pace swifter and the struggle around disposition of assets more interesting with the old parents still in the picture The insider view of Silicon Valley and its players was deliciously captivating as was the world of Stanley's and Linda's TaiwaneseAmerican friends.

Since living trusts are revocable, allowing changes or, even, dissolution, at any time, the trust and the grantor enjoy no beneficial tax treatment Creating a trust without a good estate plan. A family trust is a common tool in the estateplanning process But while a family trust has many advantages, it's important also to understand the disadvantages What Is a Family Trust A family trust is a legal device set up to benefit family members, most commonly, your spouse and/or your children It is used to avoid probate, delay taxes. A family trust is a legal device used to avoid probate, avoid or delay taxes, and protect assets Here's an overview of the various types of trusts, what can be accomplished with each, and how they are created Basic Terminology.

{NAME} FAMILY TRUST AGREEMENT {Name}, of {Address}, {State}, {Zip}, referred herein as Trustee, herewith as Settlor establishes and declares the following trust I DECLARATION OF TRUST 11 Said Trustee declares that all certain selected and designated property, income, and profit now held or acquired after the effective date of this agreement shall be controlled by him, in trust pursuant to. The Job of a Trustee The responsibilities of a trustee include management of the assets that are identified within a trust A lot of estate holders elect to act as their own trustee This is a perfectly valid option However, if the estate holder should become infirm or die unexpectedly, it is essential to have an estate plan set up in advance. A family trust is a trust in which the beneficiaries are family relations of the grantor Since the assets of a revocable trust legally belong to the grantor, beneficiaries have no rights in trust assets that are not subordinate to the grantor's right to unilaterally revoke the trust.

A living trust is one way to plan for passing on your estate—property, investments and other assets—to your family or other beneficiaries It’s a legal agreement people often use to plan ahead for the possibility of becoming mentally incapacitated or so that the burdensome probate process can be avoided when they die. A family trust is a trust created to benefit persons who are related to one another by blood, affinity, or law It can be established by a family member for the benefit of the members of the family group Family trusts acts as an instrument to pass on the assets to future generations. Creating a family trust is an effective way of managing family assets There are two common types of family trusts revocable and irrevocable living trusts When someone sets up a revocable living trust, they transfer assets into the trust for the purpose of benefiting those to whom the assets ultimately pass, called the beneficiaries.

Family Trust Insurance is a fullservice insurance agency located in Las Vegas, Nevada Visit our website or give us a call today for a free, noobligation insurance quote. A trust agreement is a document that spells out the rules that you want followed for property held in trust for your beneficiaries Common objectives for trusts are to reduce the estate tax liability, to protect property in your estate, and to avoid probate Think of a trust as a special place in which ordinary. A trust is a legal entity formed under state law, creating a relationship where one person holds title to property subject to some benefit to another person(s), referred to as a beneficiary Trusts can be created for a living person or come into existence at a person's death Many trusts require the.

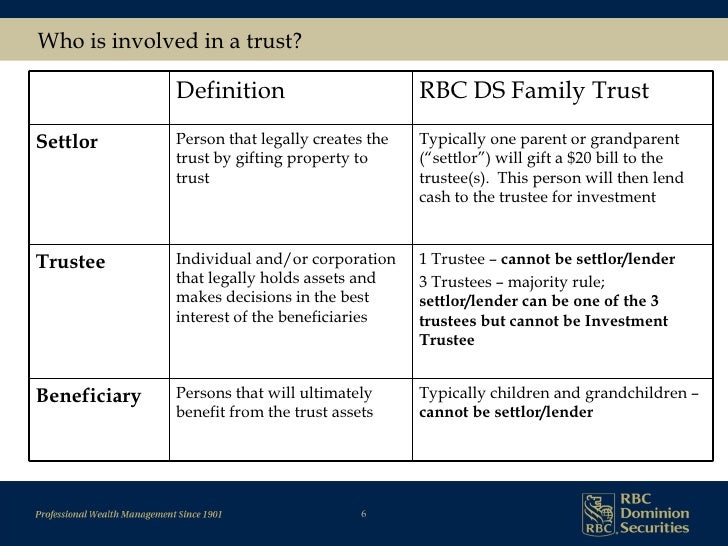

Where family trusts are utilized, and amounts are payable to children The amounts must be used for the benefit of the children Any amounts paid to the children will reduce the amount owing to them The amounts received by the children from the family trust could be used to pay certain expenses, which would otherwise have been paid by the parents. A family trust is used to pass assets on to family members or other beneficiaries and may be set up as part of an estate plan The trust is set up by the settlor – the person who owns the assets The settlor's assets are then transferred to the trust. A trust can be used to manage estate taxes, shelter assets from creditors and pass on wealth to future generationsA family trust is a specific type of trust families can use to create a financial legacy for years to come There are several benefits to creating one, though not every family necessarily needs one.

Many families set up trusts to provide for family members in need of financial assistance or to further their own estate planning goals Taxation of trusts can become extremely complicated, and. Mention the term family trust and there are often visions of lots of money floating around inside it Assets typically held in a family trust include investment properties, cash, shares and non. A Trust is an entity that owns property for the benefit of another, called the beneficiary A family Trust, also called a revocable living Trust, is a Trust created to hold the families assets in order to pass them to family members and avoid probate.

Family Trust is a conventional trust but is prepared with the principal parties being within a family The Main Types of Trusts It is vital that the correct type of trust is provided for the client Our questionnaire needs to be completed to aid in assessing your situation This is generally followed by an interview with the client. With Family Trust mobile banking, it’s more convenient than ever to access your Family Trust accounts on your Android phone or tablet The app allows you to transfer money between your Family Trust accounts and other financial institutions, make loan payments, find branches and surchargefree ATMs, and deposit checks The mobile banking app is available to Family Trust online banking users. Confidentiality – Family trusts are not publicly registered and therefore can be kept confidential Disadvantages of Family Trusts The following are a number of the disadvantages of having a family trust Loss of Ownership of Assets – If you transfer your personal assets to a trust, then the trustees of that trust will control the assets.

A family trust is a legal document that gives a trustee, often a family member, the legal authority to make decisions about the distribution of income, property or other assets to identified family members Often, a family member establishes a family trust to protect assets, create tax advantages and avoid probate actions. A family trust, also known as a “bypass trust,” is a trust created by a married couple with a large estate for the purpose of avoiding federal estate taxes when the first spouse dies The couple, known together as the “Trustors,” usually place ownership of assets whose value meets, but does not exceed, the federal estate tax exemption. A family trust is a legal document that gives a trustee, often a family member, the legal authority to make decisions about the distribution of income, property or other assets to identified family members Often, a family member establishes a family trust to protect assets, create tax advantages and avoid probate.

How My Family Trust Fund Was Stolen By Anthony Weldon Issuu

What Your Clients Can Gain By Setting Up A Family Trust Acca Global

Family Trust A Novel English Edition Ebook Wang Kathy Amazon Nl Kindle Store

Family Trust のギャラリー

In Family We Trust Altitude Business Group

Family Trust Home Facebook

Who Are We To Trust If Not Our Family Picture Quotes

F2 Finance Family Trust Leinfelden Echterdingen Facebook

/what-is-a-revocable-living-trust-3505191-v3-5bfd7964c9e77c0026f13d1d.png)

Revocable Living Trust And How It Works

Sullivan Estate Law Llc How A Living Trust Helps Your Family

Thaluvachira Family Trust Home Facebook

:format(jpeg):mode_rgb():quality(40)/discogs-images/L-301432-1515999462-5936.jpeg.jpg)

Zappa Family Trust Label Releases Discogs

Diagram What Is A Trust Diagram Full Version Hd Quality Trust Diagram Diagramof Sibce It

The Impact Of Ownership Transferability On Family Firm Governance And Performance The Case Of Family Trusts Sciencedirect

Bol Com Family Trust Ann Miller Hopkins Boeken

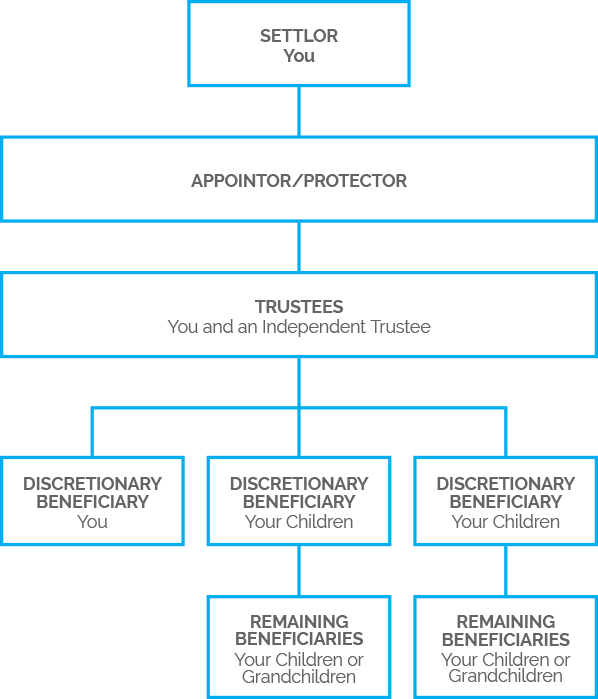

Everything You Need To Know About Family Trusts Parties To A Trust Settlor Trustees Beneficiaries Part Ppt Download

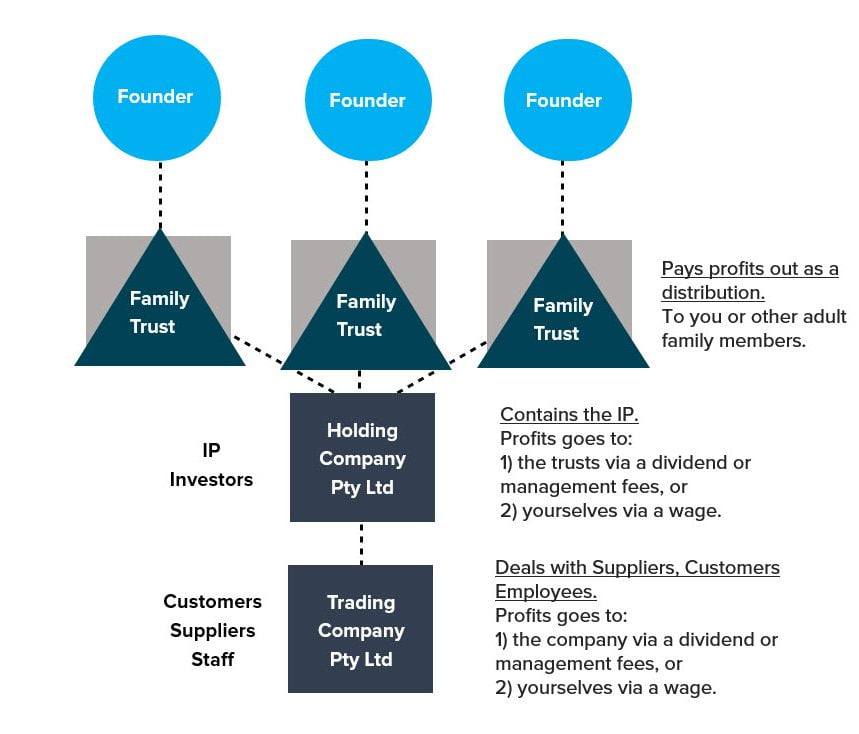

Australian Shelf Companies Your Complete Company Registration And Corporate Compliance Provider

Sample Chart Of Accounts For Family Trust Lewisburg District Umc

The Benefits Of Family Trusts Advisor S Edge

Pros And Cons Of Setting Up A Family Trust Legalzoom Com

Should I Put My Assets In A Family Trust Maya On Money

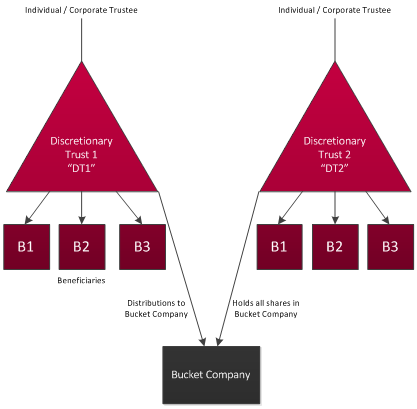

Effective Positioning Of A Bucket Company With In Family Trust Structure Propertychat

7 Valuing A Beneficiary S Interest In A Family Trust

Why Do I Need A Family Trust As Part Of My Estate Planning Baron Law Llc

Bol Com Family Trusts Hartley Goldstone Boeken

Family Trusts

Uw Specialist Is Vermogensregie Family Capital Trust Family Capital Trust

Sylvester Family Trust Finance Without Borders

Bol Com Family Trust Ebook Amanda Brown Boeken

Should I Have A Family Trust Agilis Ca

Csk Advisory Family Trust Planning

Everything You Need To Know About Family Trusts Part 1 Family Law Express Brief

The Role Of A Trustee In Your Family Trust

Family Trust Investor Fti Gmbh Linkedin

The Fischer Family Trust Fft

Why All The Fuss About Family Trusts

The Special Place For Family Trusts Cruz And Co

Family Trust Discretionary A Simple Explanation Jdg Accountants

Best Family Trust Documents Scribd

3

Pin Op Feelings Friendship Family

.webp)

Home Mysite

Is A Family Trust Right For You Adapt Wealth

3

Benefits Of Family Trust Planning In Canada Manning Elliott Llp Accountants Business Advisors

Prs Family Trust Linkedin

Trusts 101 A Guide To What They Are And How They Work In Australia The Smsf Coach

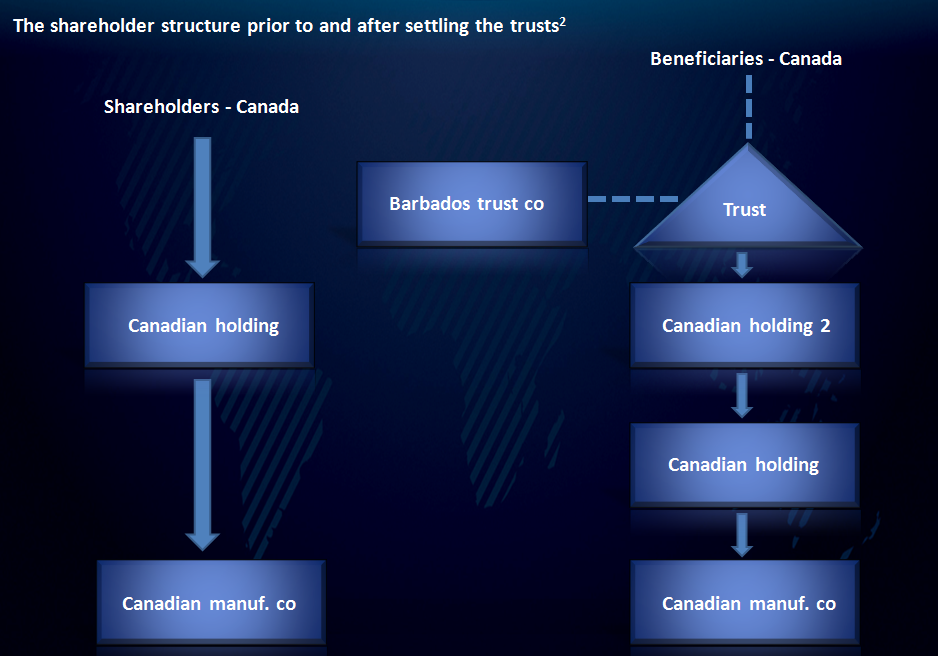

Garron Family Trust Case Tax Residence Of Trusts d Enterprisesbbd Enterprises

Are Online Trusts And Company Setups Worth The Discount For A Subdivision Project Propertychat

Why It Is Importance To Build Family Trust And Its Benefits

Kroll Family Trust Russian Art Culture Group

Setting Up A Family Trust The Basics You Need To Know

Family Trust Panama Legal Center

Family Trust Guide Mactodd Lawyers Mactodd Lawyers Macalister Todd Philips Queenstown Central Otago

What Is A Trust Lawcrest A Modern Commercial Law Firm

/Naming-your-family-trust-funds-e38335a50d1243e5909671395050ad31.gif)

Here Are Some Helpful Tips On How To Name Your Family Trust Fund

.png)

Do I Need A Will Or A Revocable Living Trust Carolina Family Estate Planning

Family Trusts Advantages And Disadvantages Of Having A Trust

Bol Com Family Trust Kathy Wang Boeken

/family-estate-planning-document-175427818-5a2dd1165b6e2400372f2d2c.jpg)

Sample Chart Of Accounts For Family Trust Lewisburg District Umc

Quotes About Can T Trust Family 21 Quotes

Trust Family Quotes Sayings Trust Family Picture Quotes

Living Abroad What About My South African Family Trust Family Trust South African South

Underwriting A Loan Transaction Where The Borrower Is A Family Trust

Van Straaten Family Trust Has Acquired Verimark Holdings Limited Deals Oaklins Netherlands Mid Market M A And Financial Advice Globally

How Do You Set Up A Family Trust In Hong Kong Trust Law Trustee

Uw Specialist Is Vermogensregie Family Capital Trust Family Capital Trust

What Are The Benefits Of A Family Trust In South Africa Tat Accounting

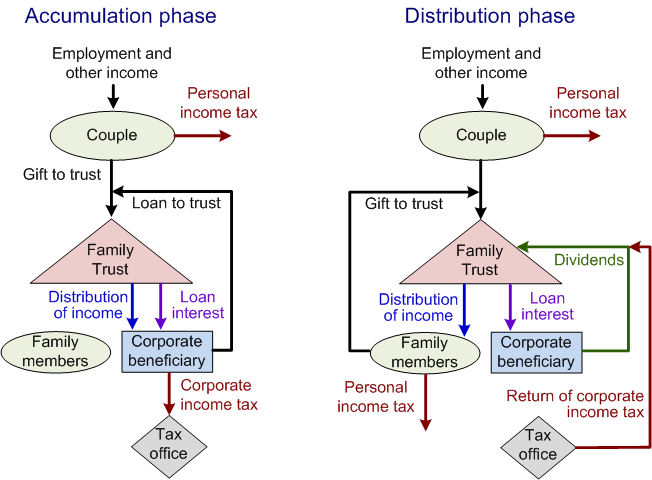

Using Family Trusts To Income Split

The Benefits Of Family Trusts Advisor S Edge

Bol Com Family Trust Kathy Wang Boeken

What Is A Family Trust Rushmore Forensic

1

Family Quotes For Hard Times His Family Is 1 Of The Disgusting Family I Could Family Love Quotes Famous Quotes About Family Beautiful Family Quotes

Q Tbn And9gcrge7qwpjonzfe028qt 4txo71nwtcfupa0pibc Woq3cjbosj8 Usqp Cau

How To Manage A Family Trust Gaze Burt

Australian Startup Structures Companies Trusts Corporate Trustees Dissecting All The Options For Founders By Kunal Kalro Medium

Mogelijkheden Met De Curacao Trust Ppt Download

What Is A Family Trust And How Do They Work Watson Watt Accountants

Why You Need A Family Trust

How To Set Up A Family Trust Quill Group Tax Accountants Gold Coast

Bol Com Family Trusts Hartley Goldstone Boeken

Bol Com Family Trust Kathy Wang Boeken

Family Trusts What You Need To Know

What Is A Family Trust The Essential Guide Box Advisory Services

Family Trust Fcu Personal Finance Services

Family Trust Inheritance Trust New Zealand Family Trust Services

Family Trust Inheritance Trust New Zealand Family Trust Services

Thaluvachira Family Trust Home Facebook

Everything You Need To Know About Family Trusts Part 1 Family Law Express Brief

Advantages And Disadvantages Of Family Trusts Ioof

K 1 Taxation Of A Family Trust Jeyakumar1962 General And Health Issues

Naming A Corporation As A Beneficiary Of A Family Trust Cv Trustco

Setting Up A Family Trust Can Save You Lots Dollar Wise

Tables For 4 Is An October 3rd Fundraiser We Ll Be Doing To Support The O Rourke Family Patrick O Rourke Was A 12 Year Vetera Bloomfield Family Trust Prentice

Family Trusts Recent Changes And Continued Benefits

What Happens To A Family Trust If The Trustee Dies Linda Alexander Law

Private Trust Companies Factsheet By Jersey Finance Issuu

Family Trusts And The Bucket Company Why Should I Use One

Trust Powerbanks Prijsbest Nl

Family Trusts Revised And Updated Pdf Chepshydkinddistni5

The Use Of Family Trusts

The Children S Family Trust Independent Fostering Agency And Charity

The Two Edged Sword Of Family Trust Distributions

Diagram What Is A Trust Diagram Full Version Hd Quality Trust Diagram Diagramof Sibce It