Asset Meaning In Accounting

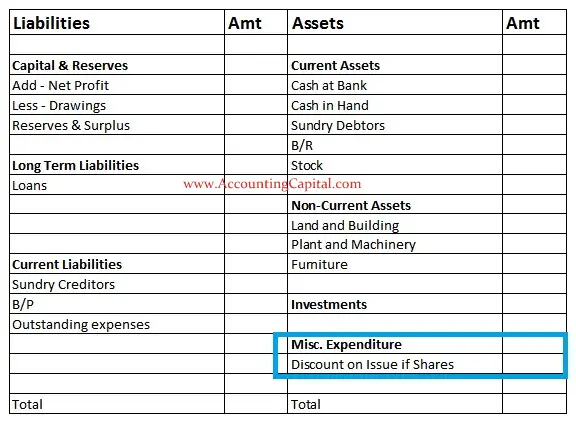

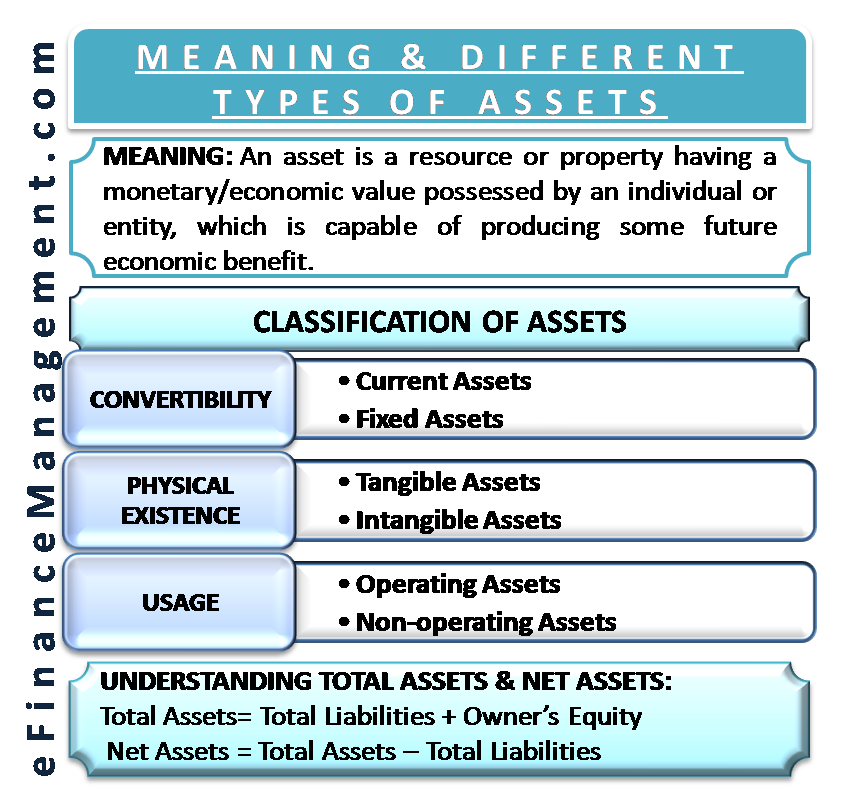

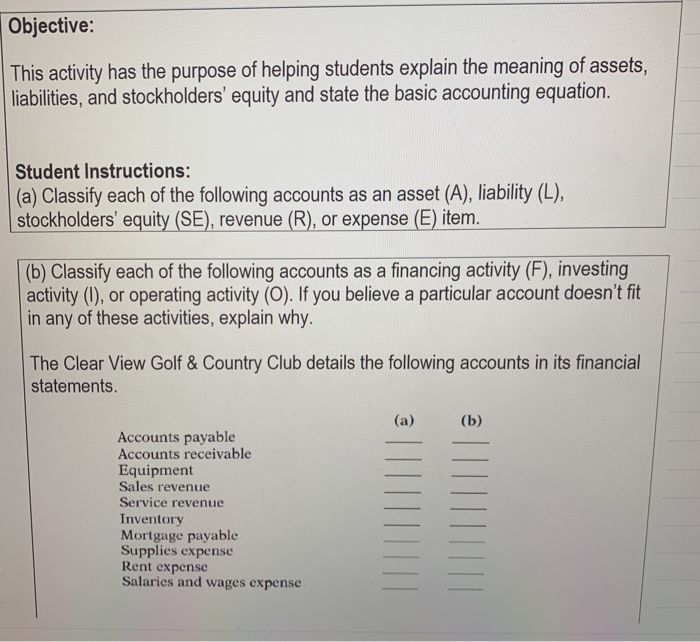

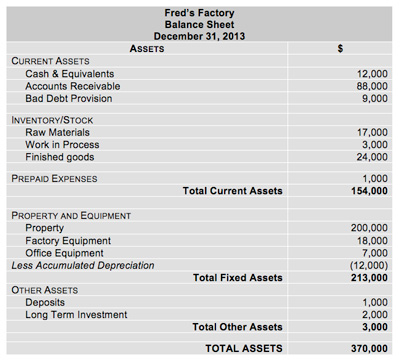

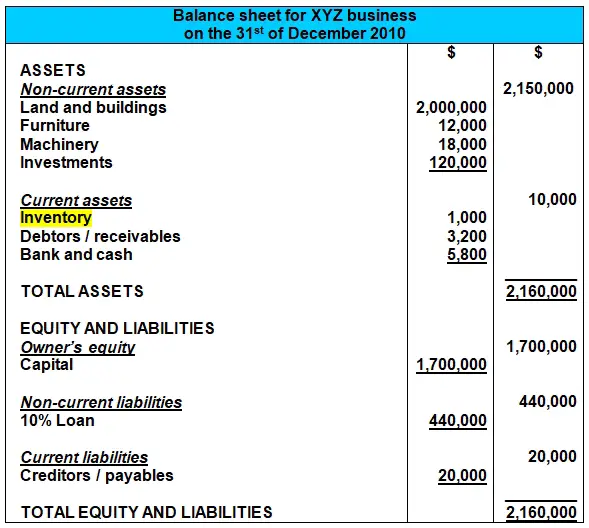

Assets definition Things that are resources owned by a company and which have future economic value that can be measured and can be expressed in dollars Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles Assets are reported on the balance sheet usually at cost or lower.

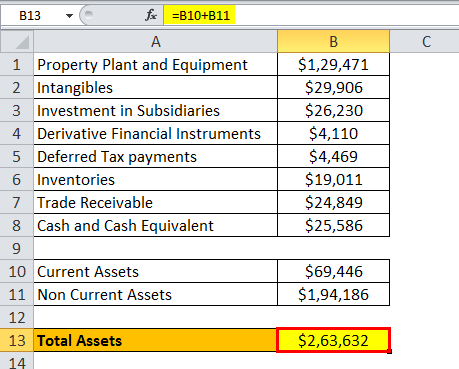

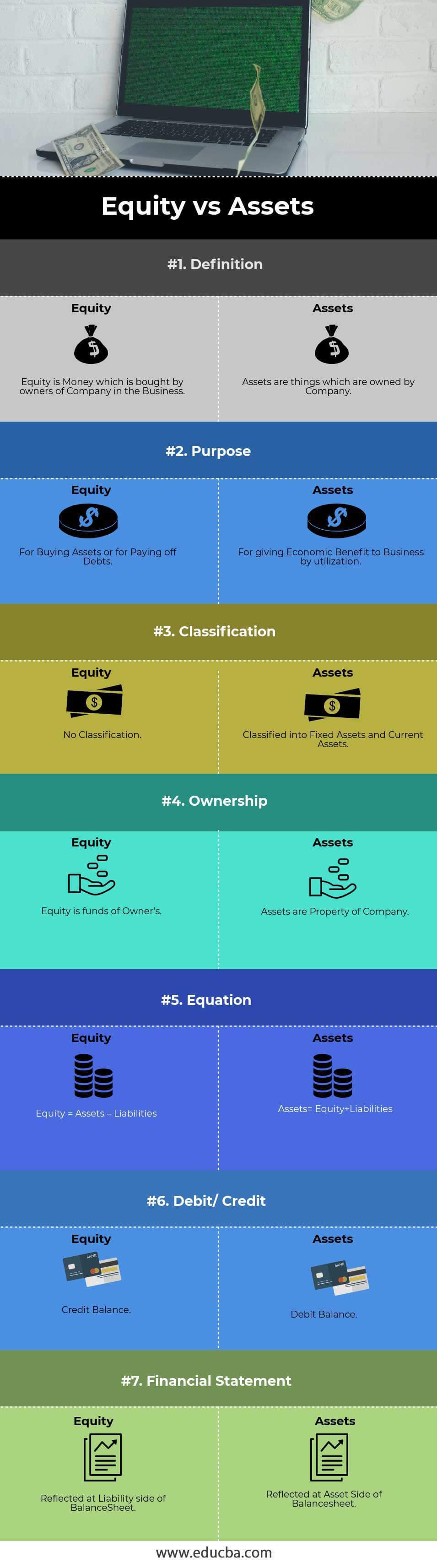

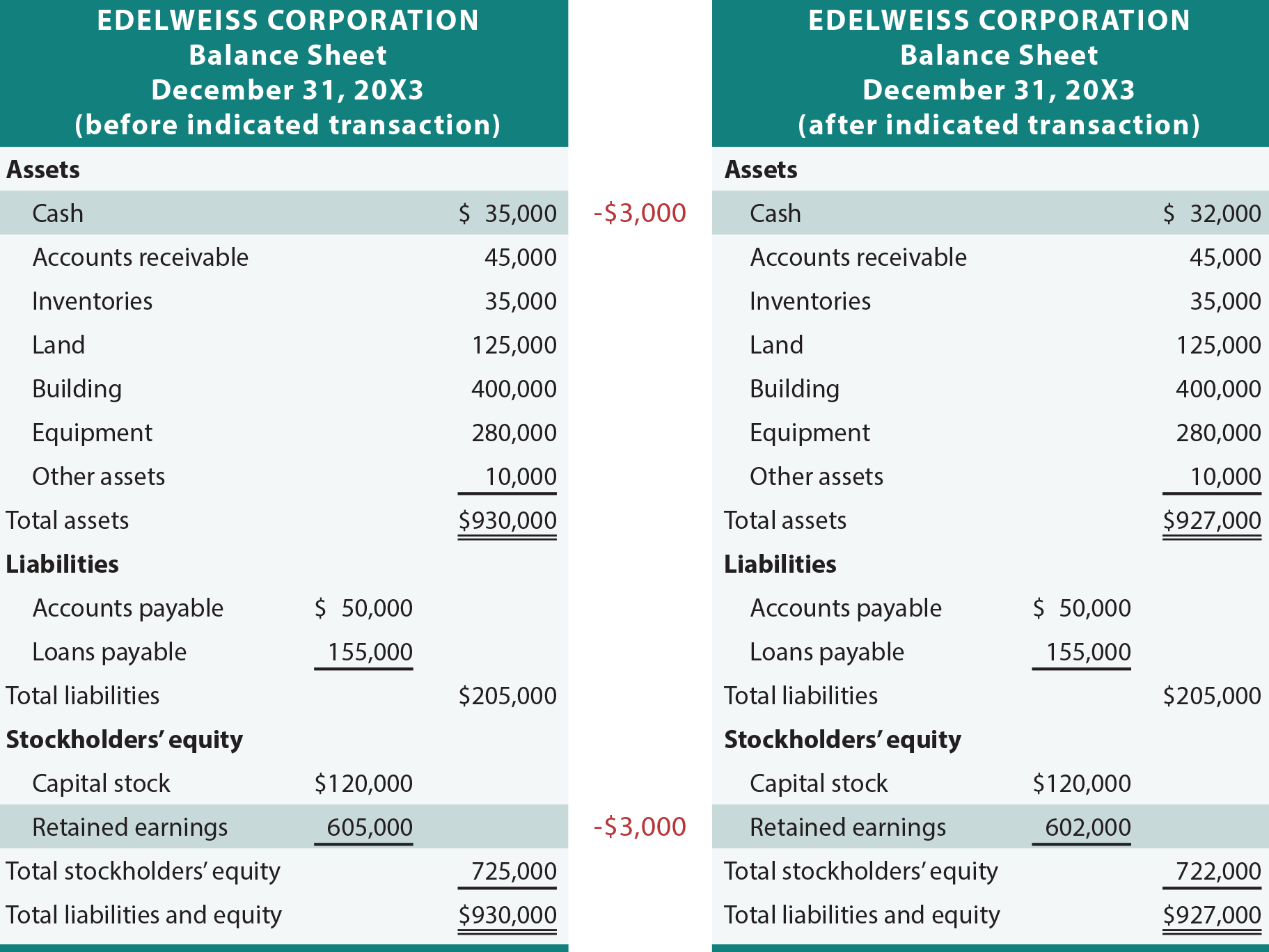

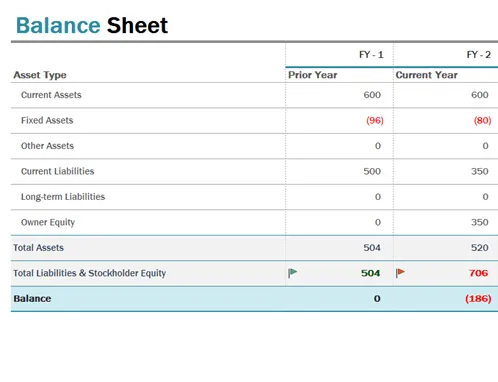

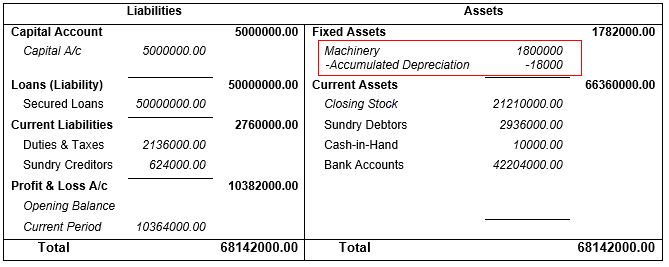

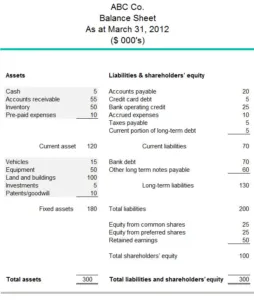

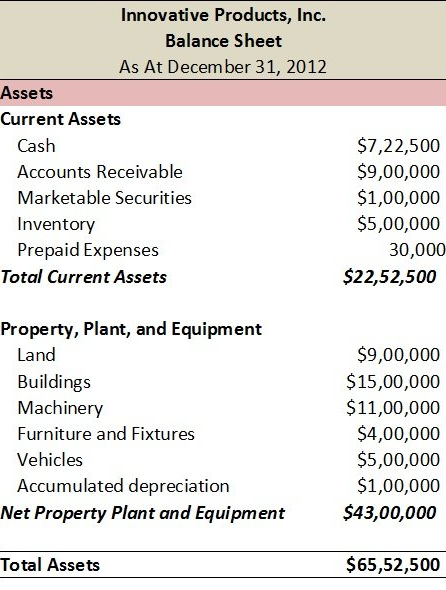

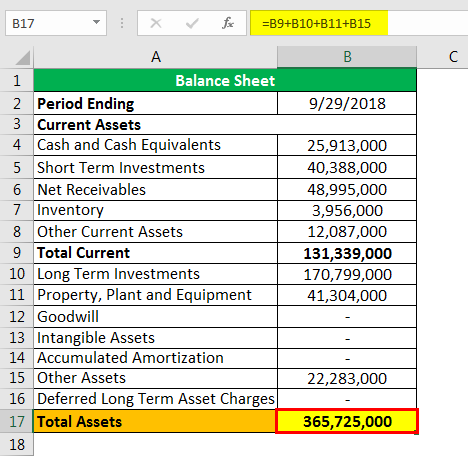

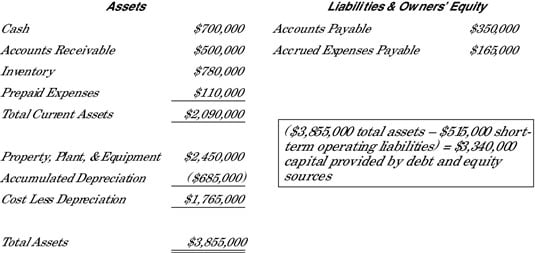

Asset meaning in accounting. The meaning of total assets is truly reflected in the accounting equation as the sum total of liabilities and owner’s equity While “Net Assets” is a term used to state the difference between total assets and total liabilities. Assets Ever heard the phrase “Tom is an asset to the company”?. Definition Assets are resources that control by the entity and those resources are expected to have the economic inflow into the entity in the future Those assets included cash, account receivables, cares, computer equipment, land, building, and any other resources that control by the entity The balance sheet is one of five financial statements that report the entity’s financial.

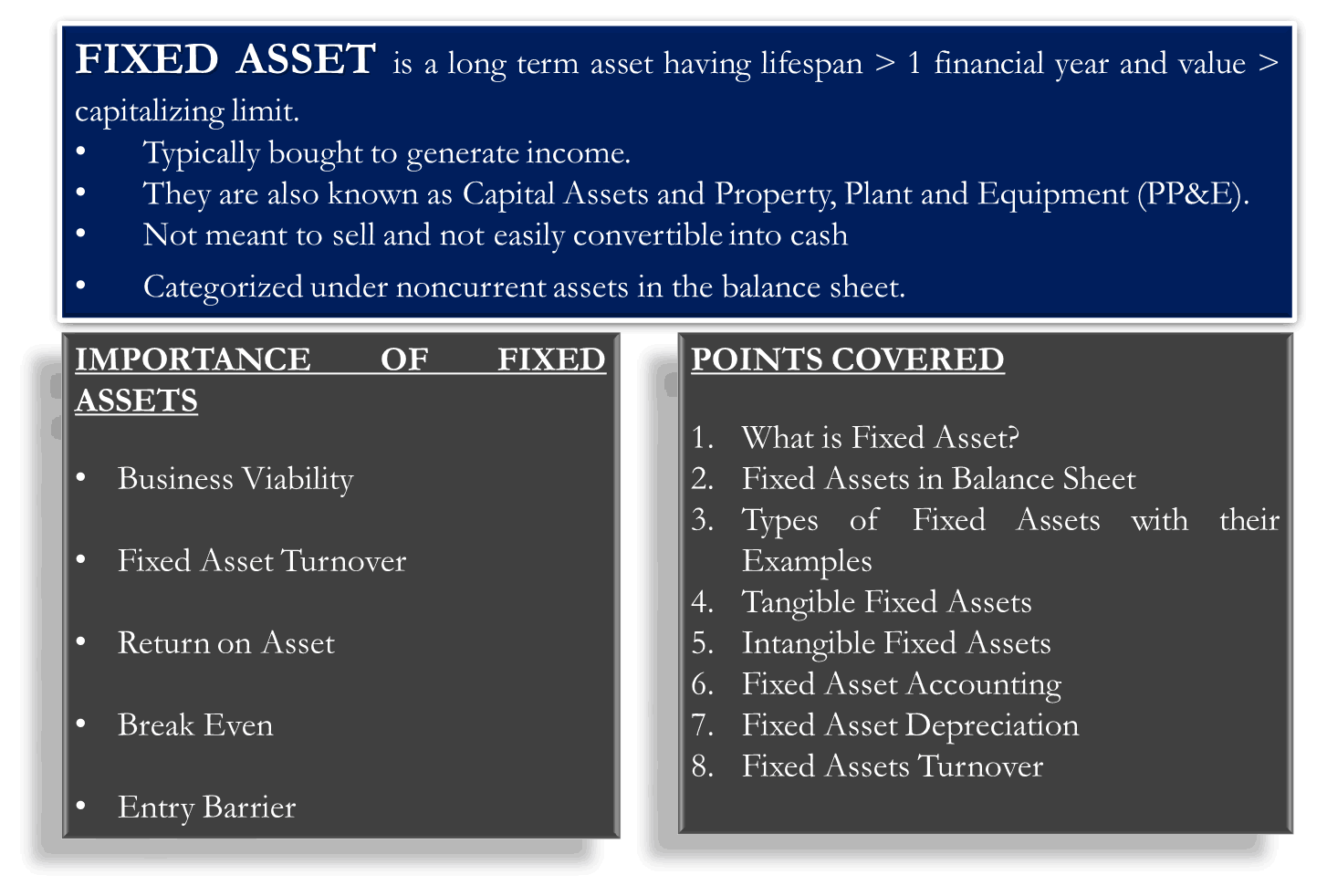

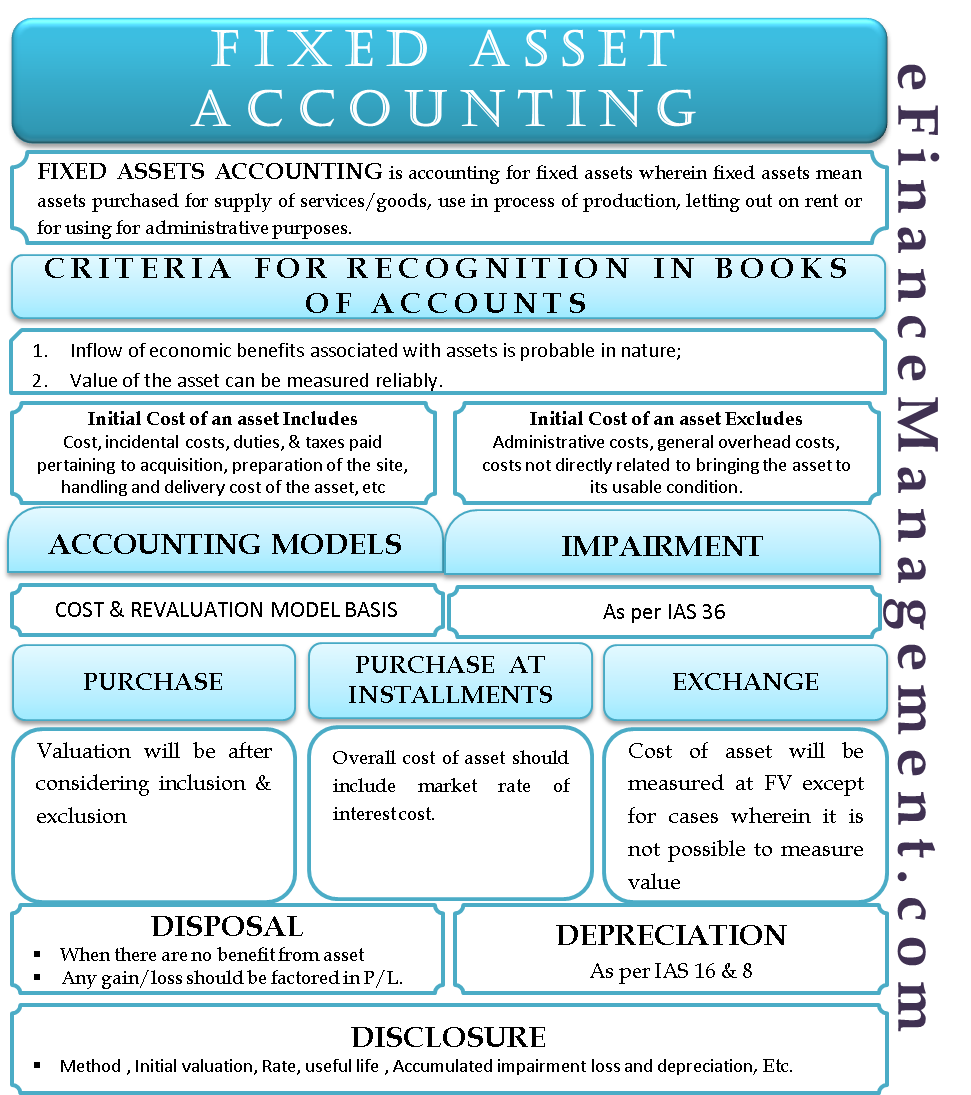

Fixed assets—also known as tangible assets or property, plant, and equipment (PP&E)—is an accounting term for assets and property that cannot be easily converted into cashThe word fixed indicates that these assets will not be used up, consumed, or sold in the current accounting year Yet there still can be confusion surrounding the accounting for fixed assets. Asset definition, a useful and desirable thing or quality Organizational ability is an asset See more. Asset definition in English dictionary, asset meaning, synonyms, see also 'assets',asset value',chargeable asset',wasting asset' Enrich your vocabulary with the English Definition dictionary.

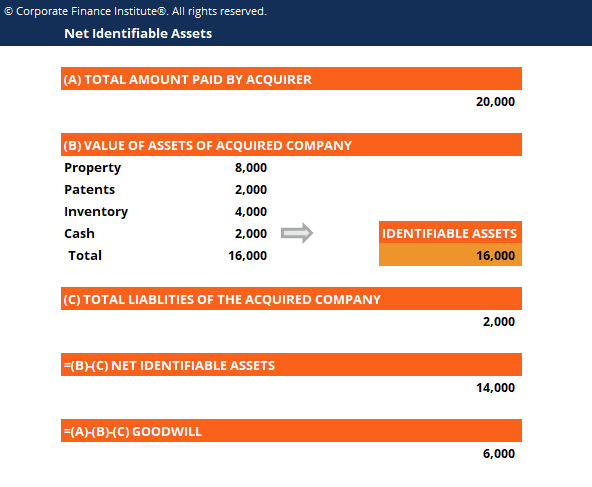

Under the PURCHASE METHOD OF ACCOUNTING, one entity is deemed to acquire another and there is a new basis of accounting for the ASSETS and LIABILITIES of the acquired company In a POOLING OF INTERESTS, two entities merge through an exchange of COMMON STOCK and there is no change in the CARRYING VALUE of the assets or liabilities. An asset that the owner intends to hold and derive benefits from for a period of more than one year Capital assets include longterm investments such as land and major equipment It is difficult to liquidate capital assets, and companies usually do so when they are extremely cash poor They are intended to help produce a business' profits and are therefore usually necessary investments. What are Assets in Accounting?.

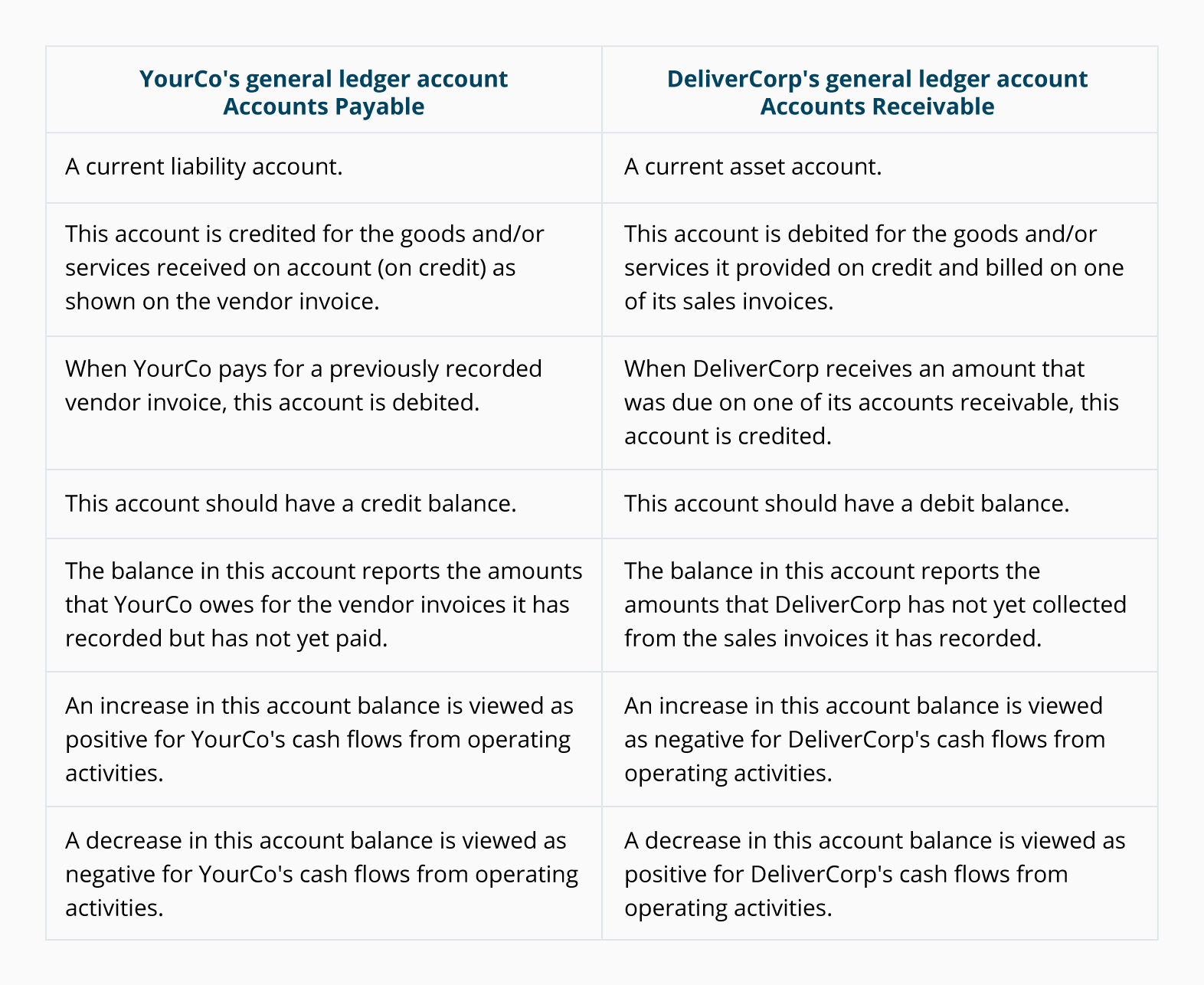

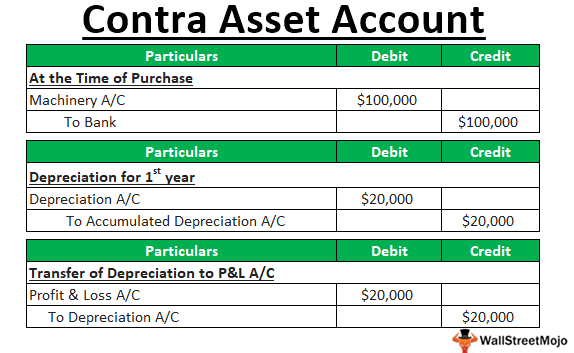

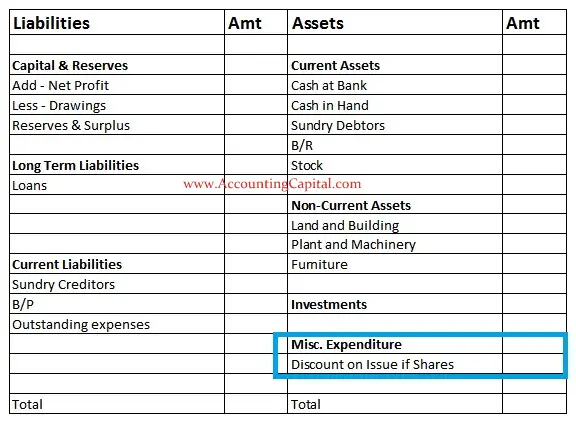

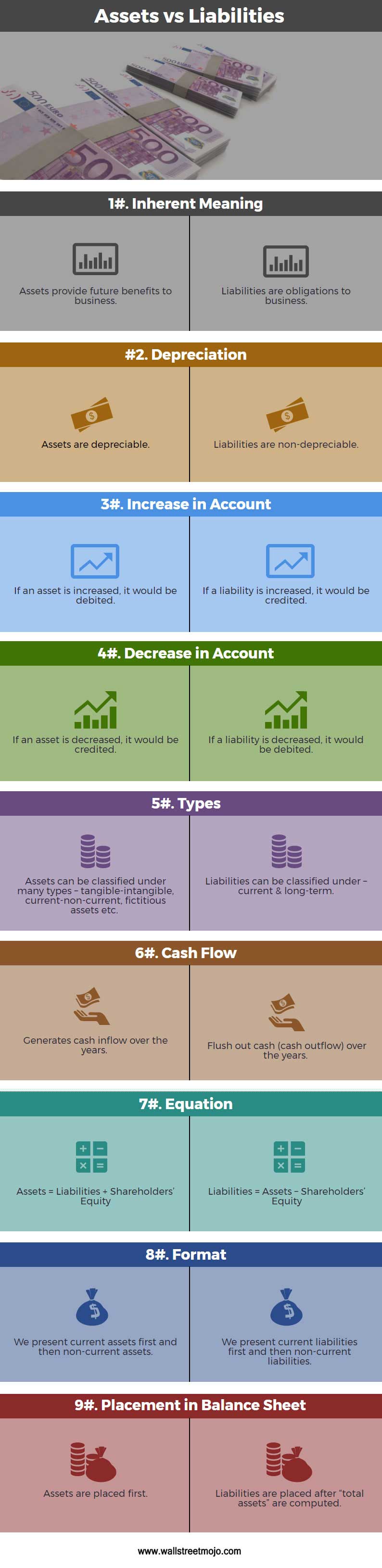

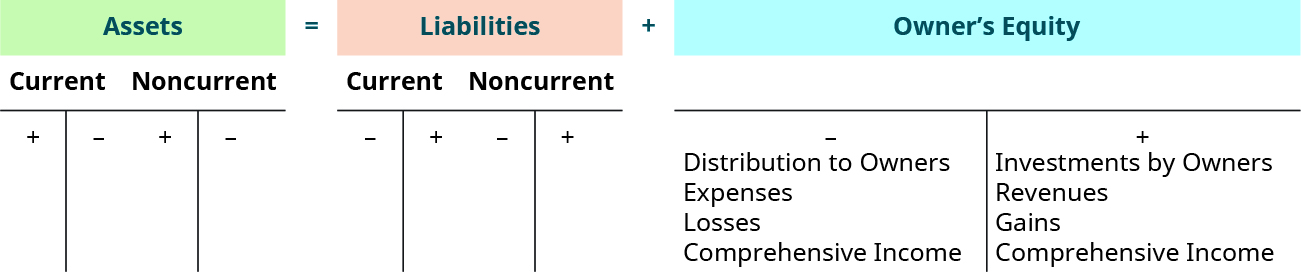

Many business assets generate revenue and benefit the owner in the longrun A business balance sheet lists your assets and shows a snapshot of how you manage assets Carefully track assets in your accounting records to ensure your books are accurate You can record asset information manually or by using accounting software. It is a contraasset account and is presented as a deduction to the related asset – accounts receivable Inventories – assets held for sale in the ordinary course of business Prepaid expenses – expenses paid in advance, such as, Prepaid Rent, Prepaid Insurance, Prepaid Advertising, and Office Supplies. Accounting equation can be simply defined as a relationship between assets, liabilities and owner’s equity in the business Accounting Equations Rules The accounting equation connotes two equations that are basic and core to accrual accounting and doubleentry accounting system.

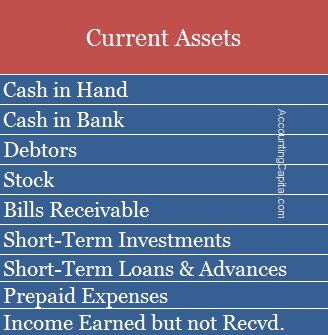

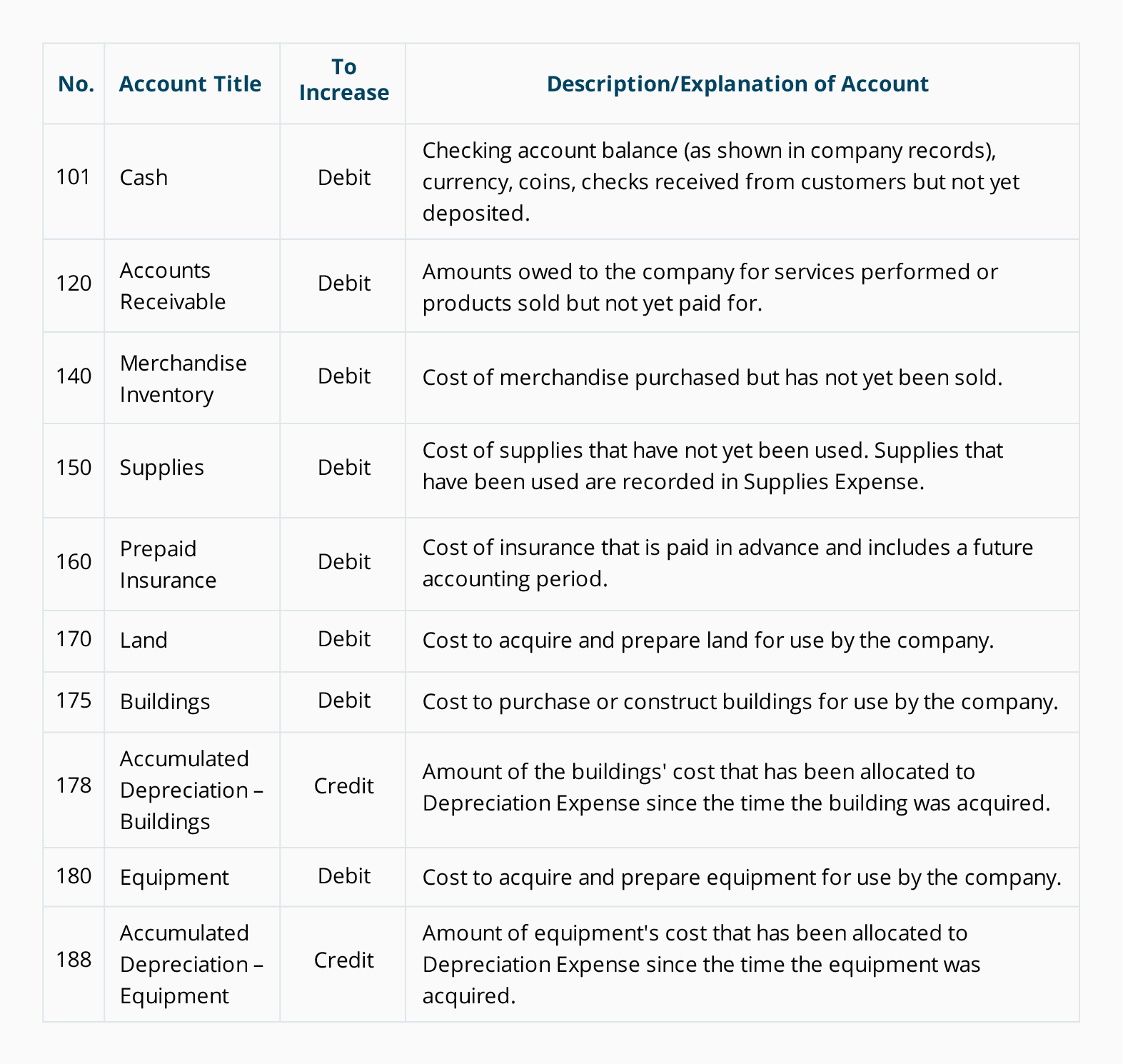

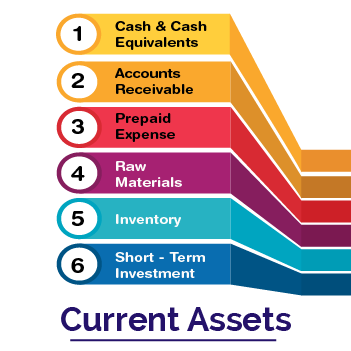

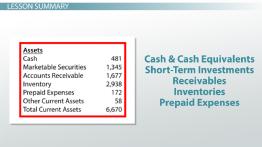

In accounting, goodwill is the value of the business that exceeds its assets minus the liabilities It represents the nonphysical assets, such as the value created by a solid customer base, brand recognition or excellence of management. Current assets are the key assets that your business uses up during a 12month period and will likely not be there the next year Current asset accounts include the following Cash in Checking Any company’s primary account is the checking account used for operating activities This is the account used to deposit revenues and pay expenses. For accounting purposes, fiscal quantifiability must define assets Assets are the measurable resources of a company, able to be expressed in terms of a monetary value.

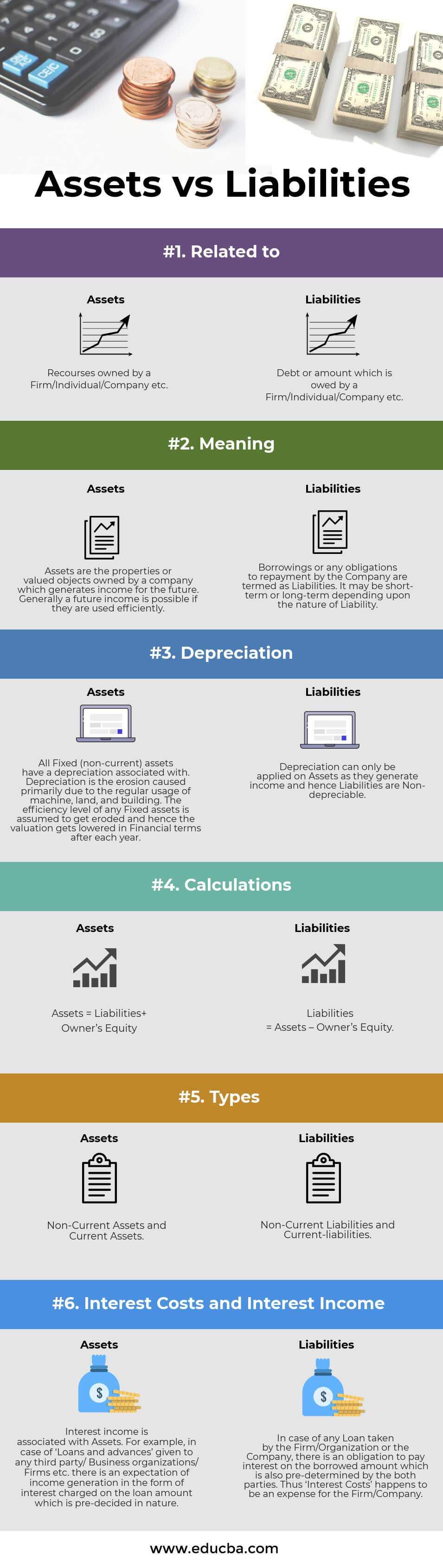

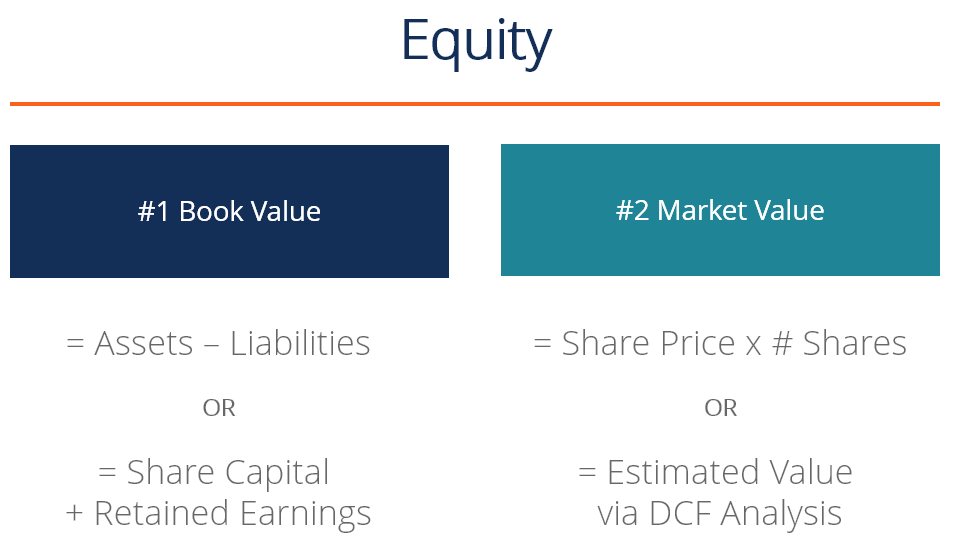

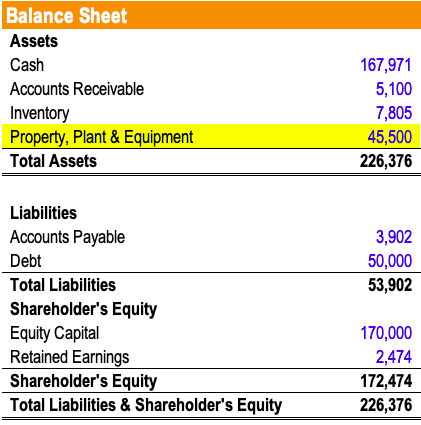

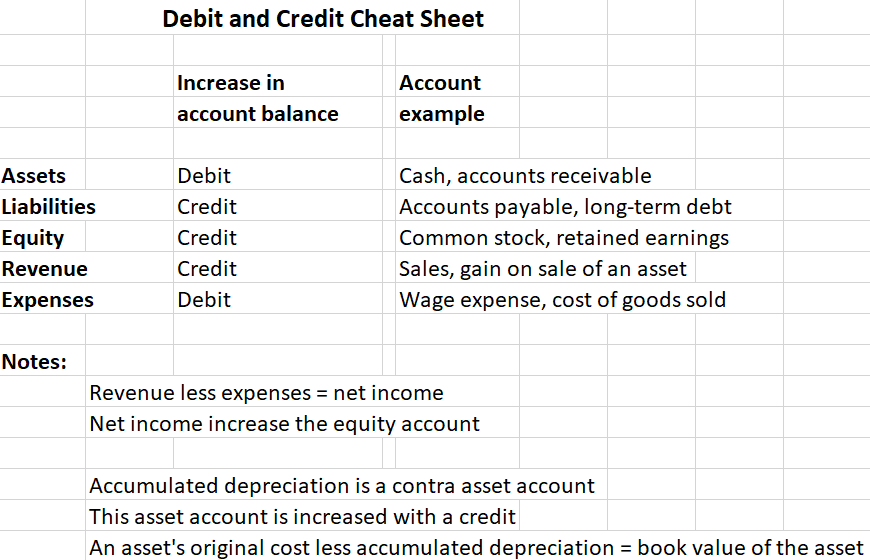

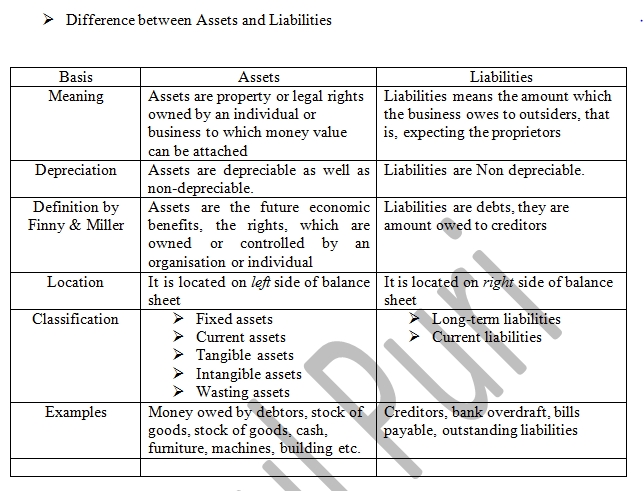

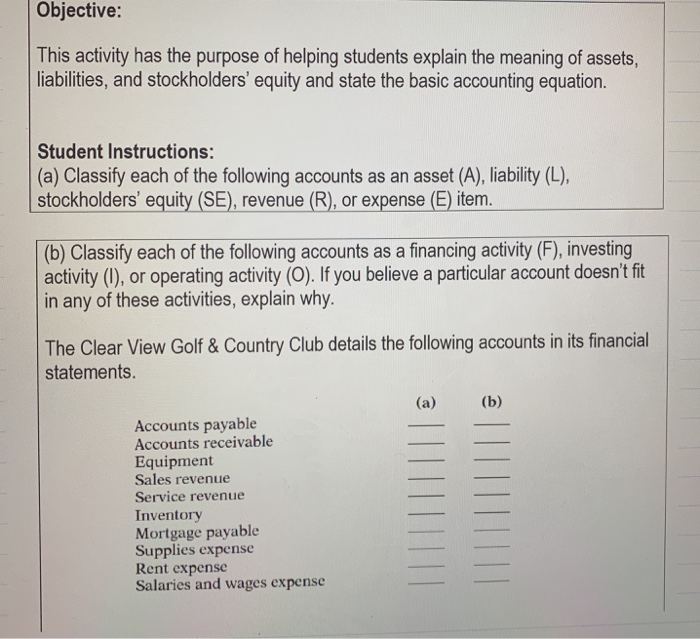

The words “asset” and “liability” are two very common words in accounting/bookkeeping Assets are defined as resources that help generate profit in your business You have some control over it Liability is defined as obligations that your business needs to fulfill In simple words, Liability means credit. O E Owner’s Equity;. Financial Assets Accounting Asset Definition In accounting, an asset has two criteria a company must own or control it, and it must be expected to generate future benefit for that company Assets on Balance Sheet A company records the value of its assets on the balance sheet Assets can be classified as current assets or as noncurrent assets.

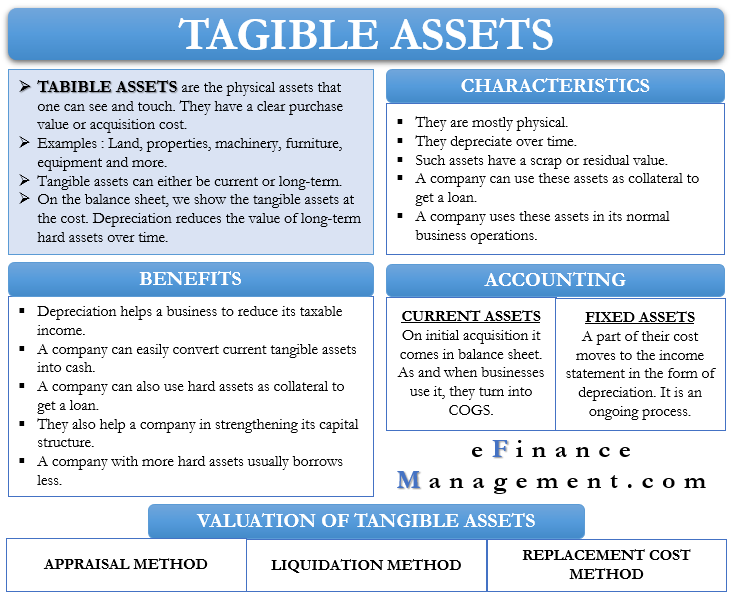

Tangible Assets – Meaning, Importance, Accounting and More Accounting As said above, the hard assets come in the balance sheet at the original cost But finally, all these assets find their place in the profit and loss account, either by way of depreciation or conversion to debtors and cash, etc. An asset is anything that will add future value to your business Asset Recognition Criteria in Accounting But the definition of assets above is not yet complete In accounting we have specific criteria which need to be fulfilled in order to recognize an asset in our accounting records. Current assets are the key assets that your business uses up during a 12month period and will likely not be there the next year Current asset accounts include the following Cash in Checking Any company’s primary account is the checking account used for operating activities This is the account used to deposit revenues and pay expenses.

This is one of the basic concepts of accounting The equation for the same goes like this Assets = Liabilities Owner’s Equity Here is the meaning of every term that ALOE stands for Assets Assets are the items that belong to you and you are the owner of it These items correspond to. An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill. Asset – definition and meaning In finance and accounting, an asset refers to anything of economic value that we own In fact, it is anything that a person finds useful or valuable Anything that we can convert to cash is probably an asset Assets are items that people, companies, or even a country owns or controls We also expect that assets.

Asset management has two general definitions, one relating to advisory services and the other relating to corporate finance In the first instance, an advisor or financial services company provides asset management by coordinating and overseeing a client's financial portfolio eg, investments, budgets, accounts, insurance and taxes. Royalty Meaning in Accounting Royalty is nothing but a periodical payment made by the user of the asset to the owner or the creator of such an asset for its use In other words, the owner/author of the asset such as mine, patent, book, artistic work etc may allow the third party like licensee, publisher etc to use its creation in exchange of a. Definition An asset is a resource that owned or controlled by a company and will provide a benefit in current and future periods for the business In other words, it’s something that a company owns or controls and can use to generate profits today and in the future.

You should be familiar with the definition of an asset in a company and how to account for them on the balance sheet However, you may not know how an asset such as land with minerals is handled in accounting Depending on the company and its resource / asset in use, these methods reduce the value of the asset / resource which is taken into. Definition An asset is a resource that has some economic value to a company and can be used in a current or future period to generate revenues These resources take many forms from cash to buildings and are recorded on the balance sheet until they are used. It is a contraasset account and is presented as a deduction to the related asset – accounts receivable Inventories – assets held for sale in the ordinary course of business Prepaid expenses – expenses paid in advance, such as, Prepaid Rent, Prepaid Insurance, Prepaid Advertising, and Office Supplies.

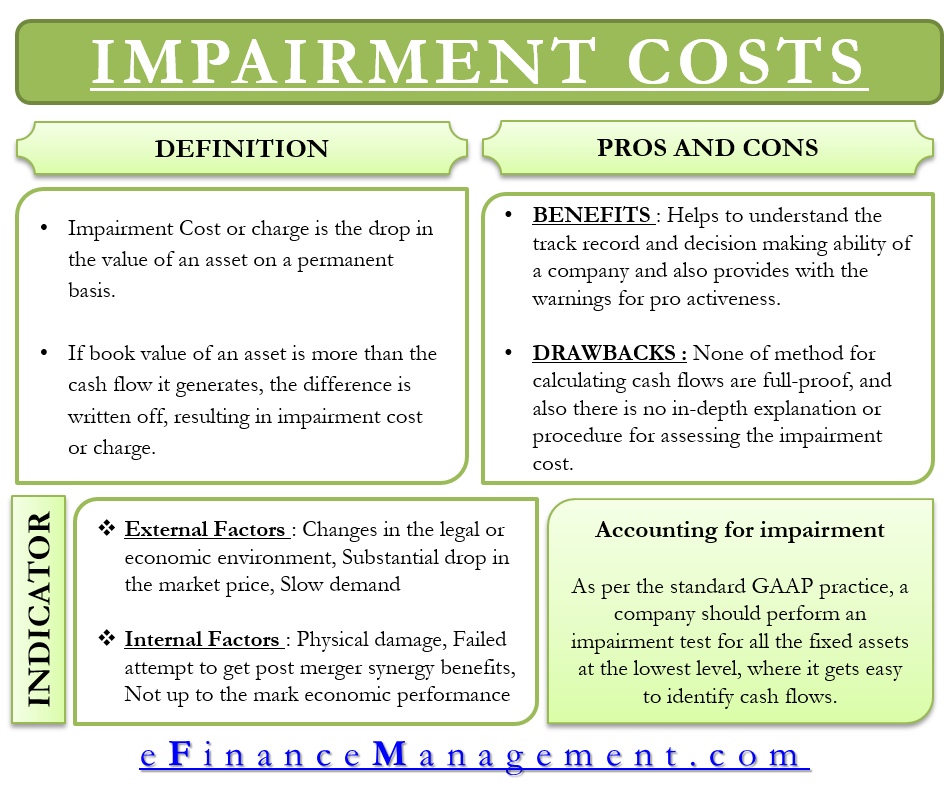

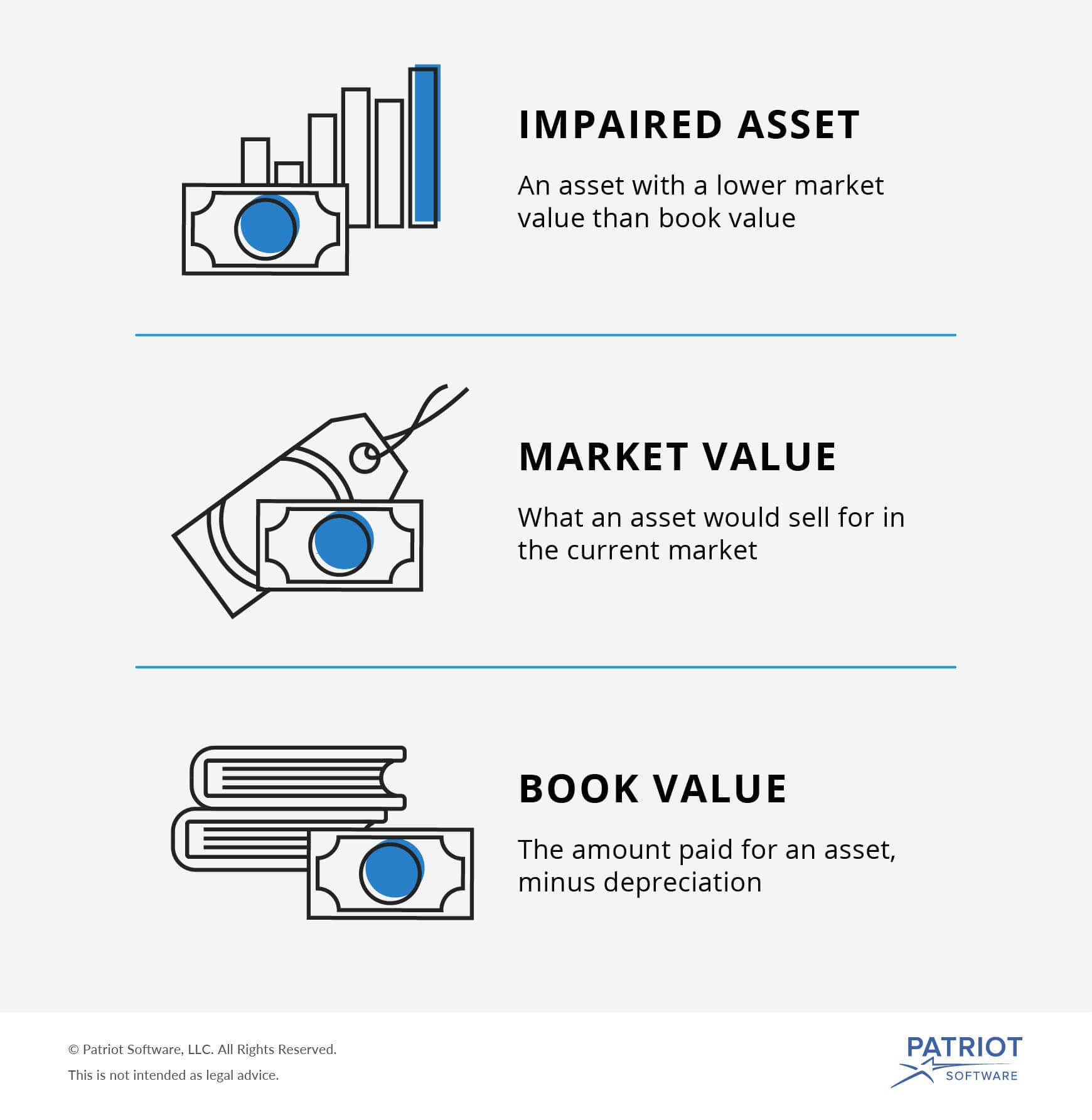

Impairment of assets may sound similar to the accounting processes of depreciation and amortization (a reduction in the value of an asset over the course of its useful life) While there are some relatively clear similarities between the two concepts, there’s one key distinction impairment denotes a sudden, irreversible drop in value. Fundamentally, accounting comes down to a simple equation Assets = Liabilities Equity It seems simple enough but let’s really break it down What do these terms mean in relation to your business and how can they help you make sense of the books?. Accounting Equation Definition Accounting Equation states that sum of the total liabilities and the owner’s capital is equal to the company’s total assets and it is one of the most fundamental parts of the accounting on which the whole double entry system of accounting is based.

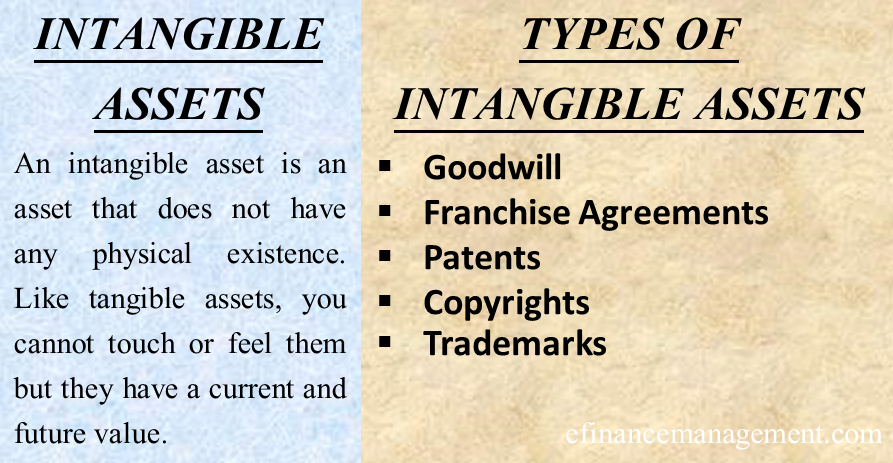

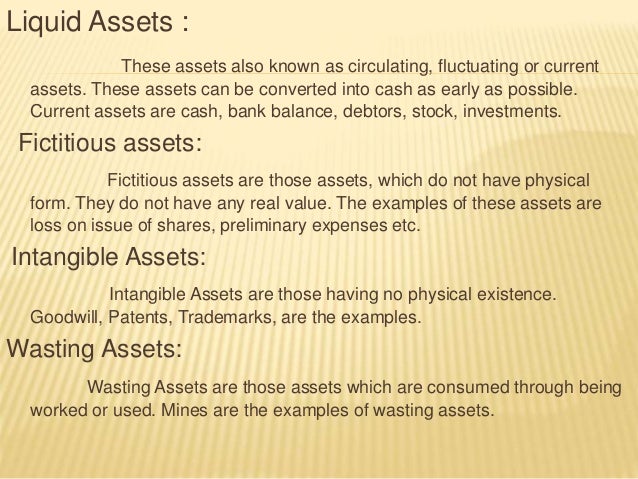

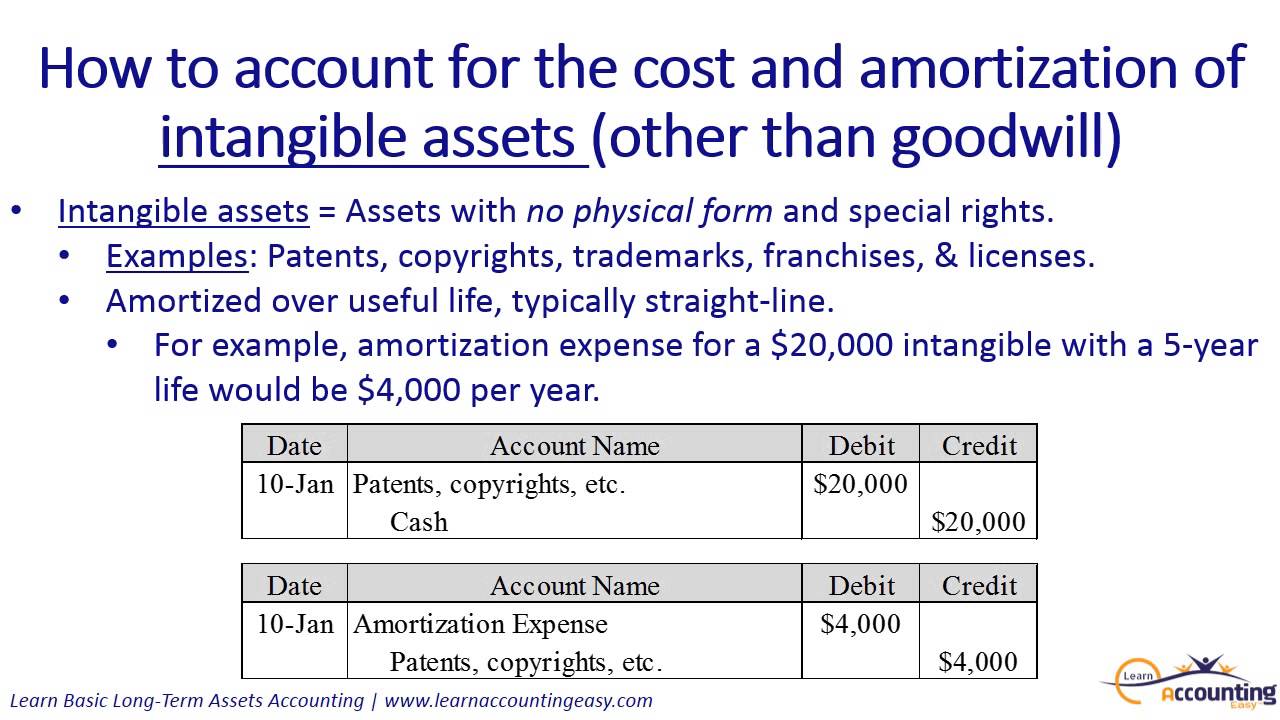

In accounting, an intangible asset is a resource with longterm financial value to a business It also isn’t a material object The meaning of intangible is something that can’t be touched or physically seen, according to the Cambridge Dictionary. An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit Assets are reported on a. Asset disposal is the act of selling an asset usually a long term asset that has been depreciated over its useful life like production equipment Disposal of Assets Explanation According to its depreciation, many companies contain an asset disposal policy to replace equipment.

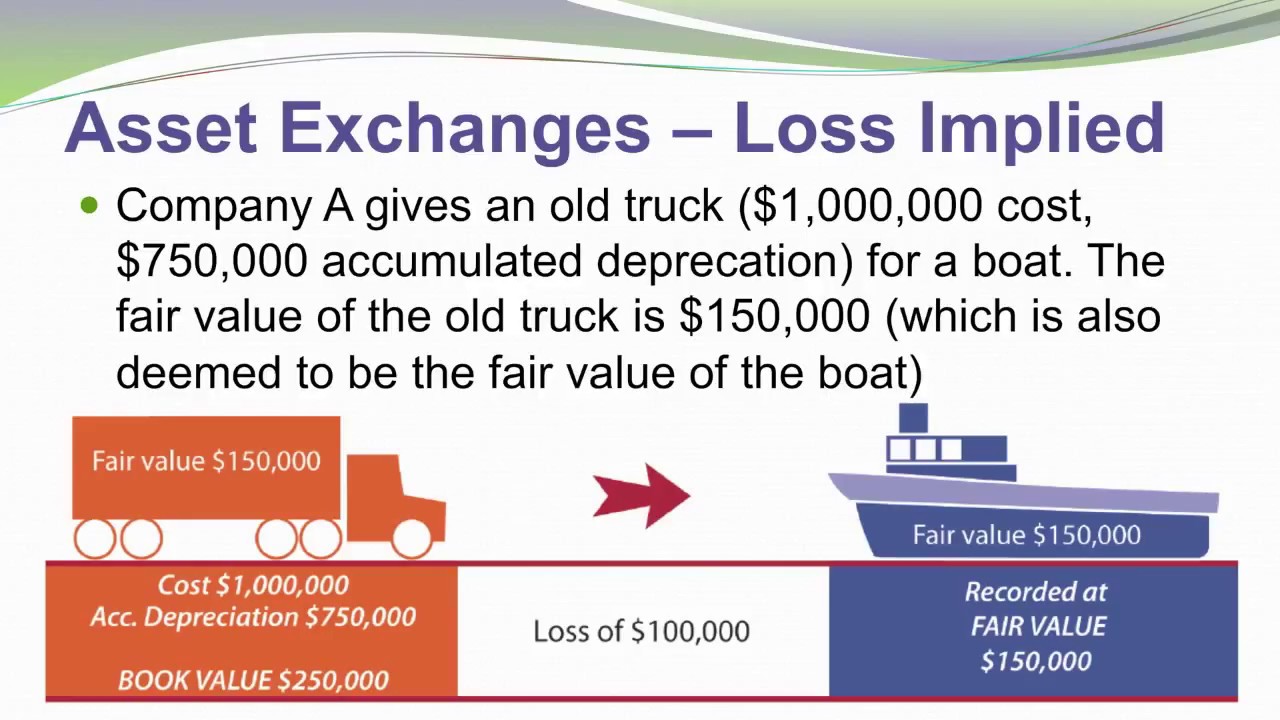

In accounting and bookkeeping, a company's assets can be defined as Resources or things of value that are owned by a company as the result of company transactions Prepaid expenses that have not yet been used up or have not yet expired Costs that have a future value that can be measured. Asset turnover is a comparison of sales to assets The intent is to show the amount of sales generated by investing in a certain amount of assets Thus, a high turnover ratio should mean that management is making excellent use of a small investment in assets to create a. Fixed assets are subject to depreciation to account for the loss in value as the assets are used, whereas intangibles are amortized 134 Fixed Asset Noncurrent Assets Definition.

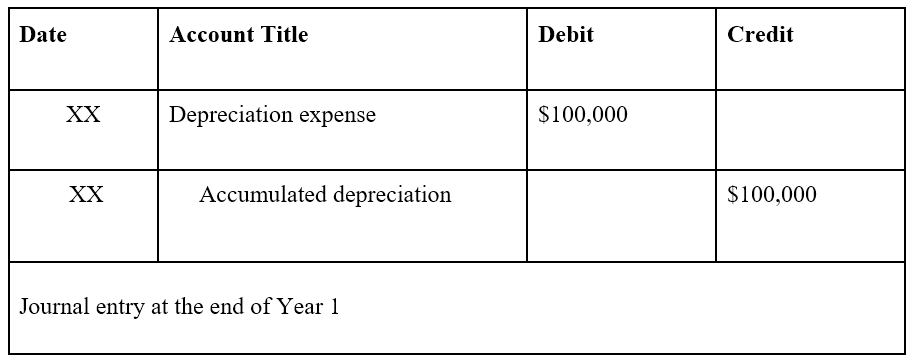

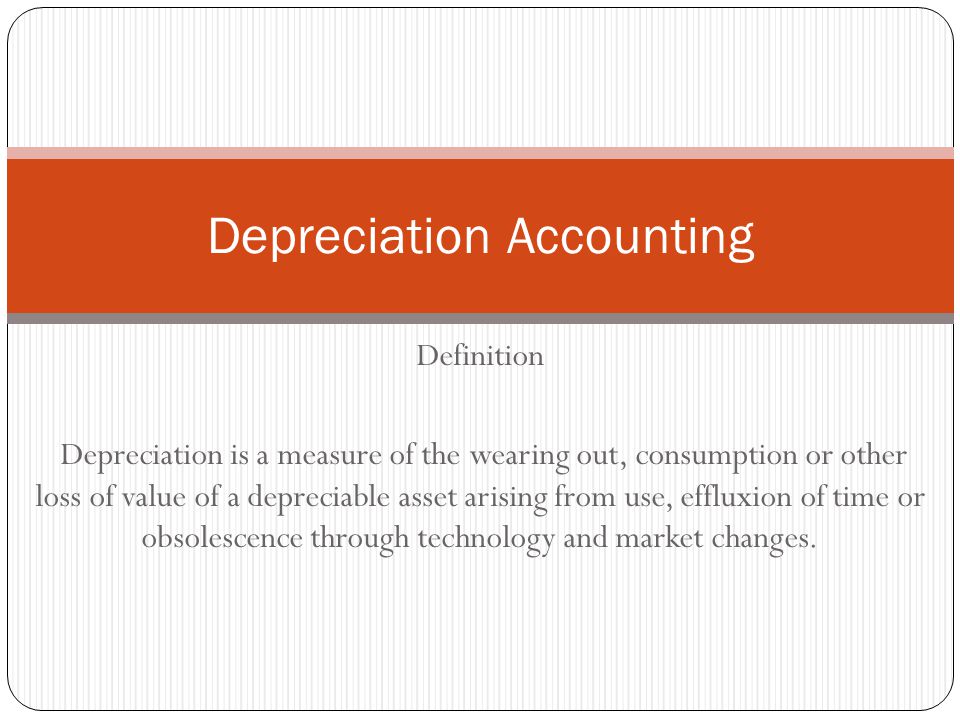

Definition Generally Speaking depreciation is the gradual decrease in the value of an asset due to any causeIt has been defined as “The permanent and continuing diminution in the quality,quantity or value of an asset“. This is one of the basic concepts of accounting The equation for the same goes like this Assets = Liabilities Owner’s Equity Here is the meaning of every term that ALOE stands for Assets Assets are the items that belong to you and you are the owner of it These items correspond to. In financial accounting, an asset is any resource owned or controlled by a business or an economic entity It is anything (tangible or intangible) that can be utilized to produce value and that is held by an economic entity and that could produce positive economic valueSimply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered.

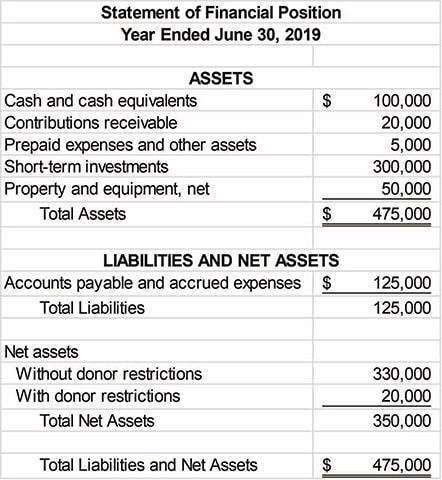

In accounting, an intangible asset is a resource with longterm financial value to a business It also isn’t a material object The meaning of intangible is something that can’t be touched or physically seen, according to the Cambridge Dictionary. Fundamentally, accounting comes down to a simple equation Assets = Liabilities Equity It seems simple enough but let’s really break it down What do these terms mean in relation to your business and how can they help you make sense of the books?. The asset's fair value less the cost of selling this asset Noncurrent assets 'held for sale' should be presented separately on the face of the statement of financial position as a current asset For a noncurrent asset (Fixed Asset) to be classified as 'held for sale', all of the following 4 conditions must be satisfied.

Asset – definition and meaning In finance and accounting, an asset refers to anything of economic value that we own In fact, it is anything that a person finds useful or valuable Anything that we can convert to cash is probably an asset Assets are items that people, companies, or even a country owns or controls We also expect that assets. What is Asset Disposal?. Accounting Standard 6 issued by the Institute of the Chartered Accountants of India defines ‘depreciation’ as “a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes.

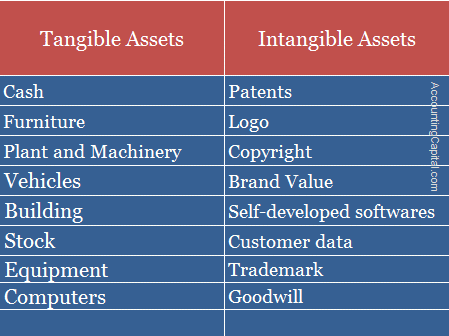

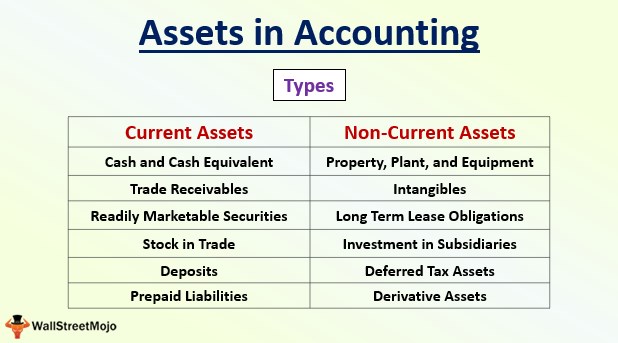

You should be familiar with the definition of an asset in a company and how to account for them on the balance sheet However, you may not know how an asset such as land with minerals is handled in accounting Depending on the company and its resource / asset in use, these methods reduce the value of the asset / resource which is taken into. Assets belonging to this category are cash, cash equivalents, and inventory Non Current Assets As opposed to Current Assets, it normally takes a year or more to convert these assets into cash Noncurrent assets are further classified into Tangible and Intangible Assets Tangible assets manifest a physical existence or appearance. Assets Ever heard the phrase “Tom is an asset to the company”?.

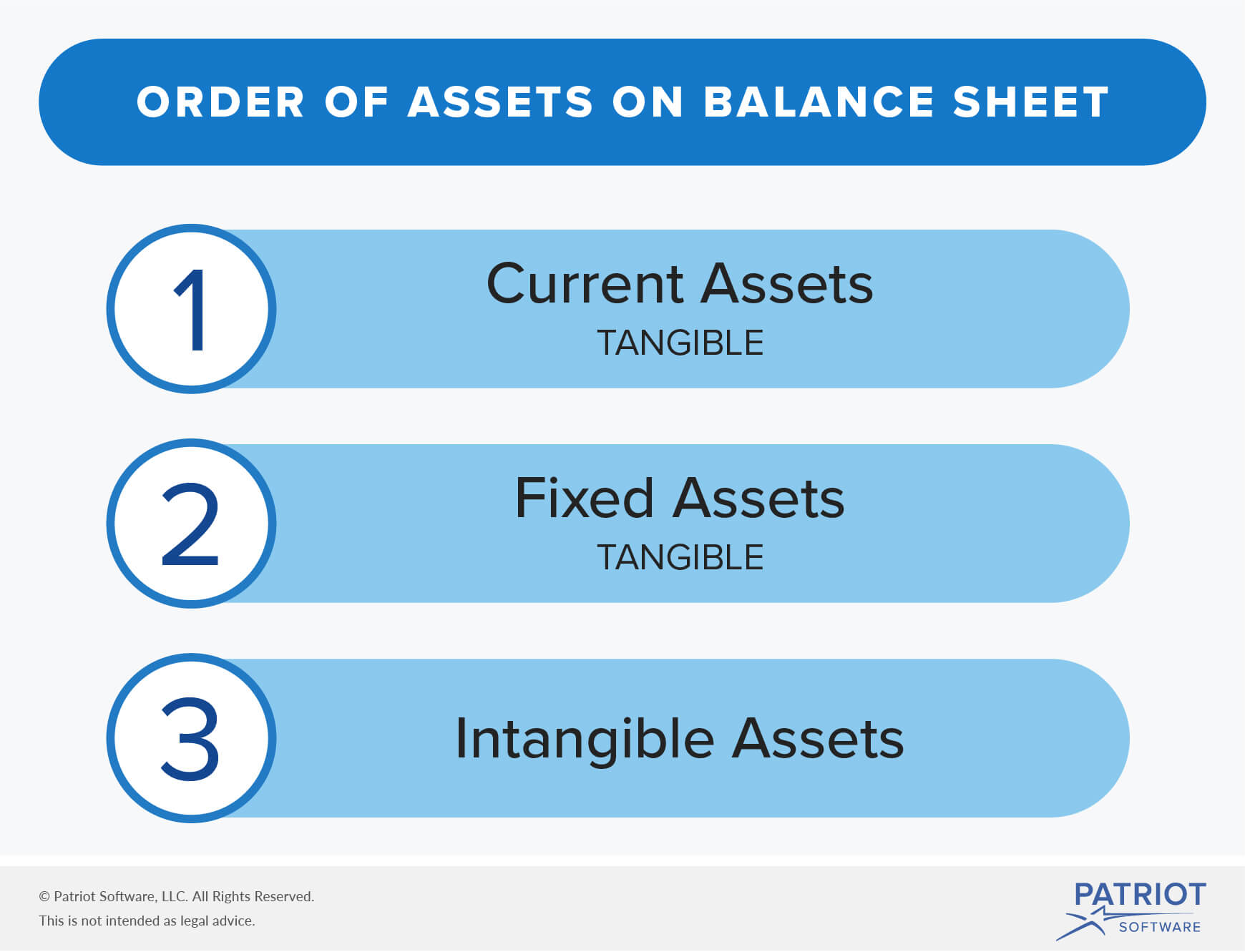

Accounting Standard 6 issued by the Institute of the Chartered Accountants of India defines ‘depreciation’ as “a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes. Contra asset accounts are a type of asset account where the account balance may either be a negative or zero balance This type of account can equalize balances in the asset account that it is paired with on a business's balance sheet The contra asset account has credited balances that can reduce the balance in its paired asset account. If assets are classified based on their convertibility into cash, assets are classified as either current assets or fixed assets An alternative expression of this concept is shortterm vs longterm assets 1 Current Assets Current assets are assets that can be easily converted into cash and cash equivalents (typically within a year).

An unencumbered asset is much easier to sell or transfer than one with an encumbrance Examples of common unencumbered assets are houses free from mortgages and other liens, cars with paid off loans/notes, or stocks purchased in a cash account An encumbrance is a claim against a property by a party that is not the owner Types of Encumbrances. Tangible Assets – Meaning, Importance, Accounting and More Accounting As said above, the hard assets come in the balance sheet at the original cost But finally, all these assets find their place in the profit and loss account, either by way of depreciation or conversion to debtors and cash, etc. The most important equation in all of accounting Let’s take the equation we used above to calculate a company’s equity Assets – Liabilities = Equity And turn it into the following Assets = Liabilities Equity Accountants call this the accounting equation (also the “accounting formula,” or the “balance sheet equation”) It might not seem like much, but without it, we wouldn.

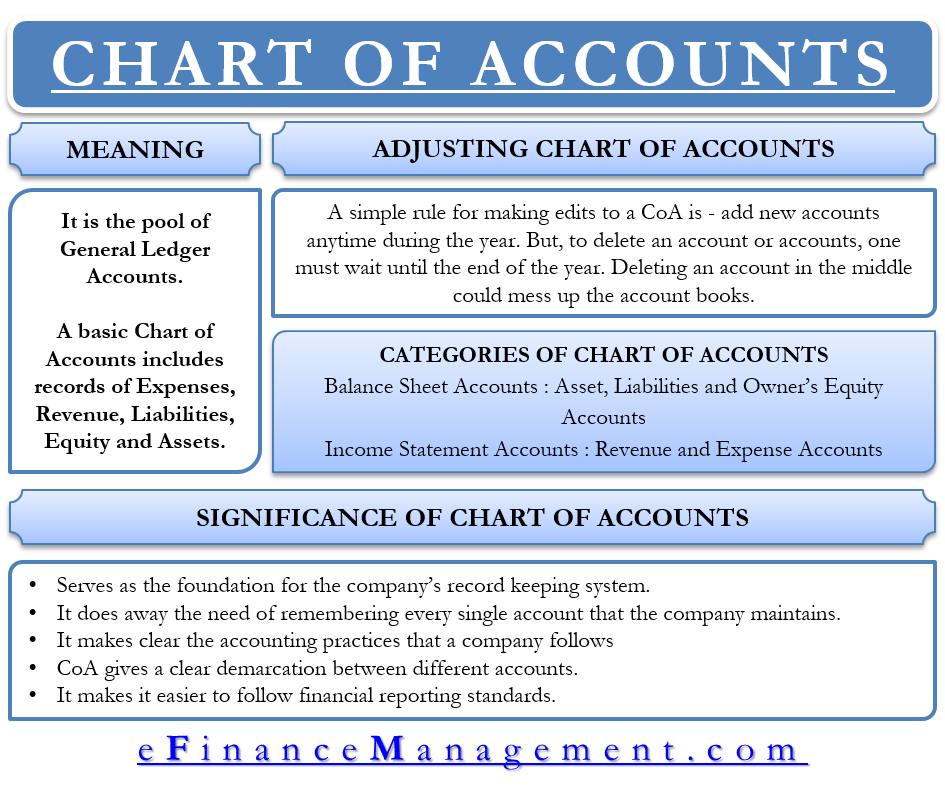

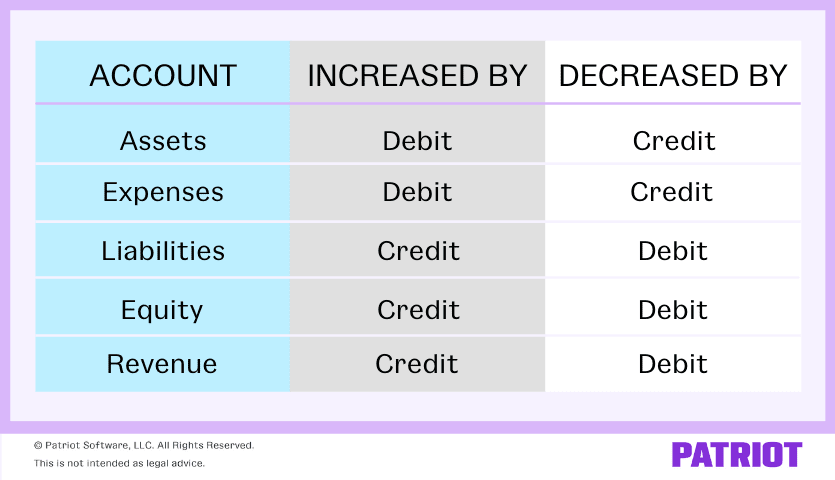

Meaning of Depreciation The monetary values of all tangible assets tend to reduce gradually over time due to factors like wear and tear The meaning of depreciation, in very simple words, is the rate at which this value drops Hence, it compares an asset’s current value with its original cost at the time of acquisition or purchase. Account Type Overview The five account types are Assets, Liabilities, Equity, Revenue (or Income) and ExpensesTo fully understand how to post transactions and read financial reports, we must understand these account typesWe'll define them briefly and then look at each one in detail Assets tangible and intangible items that the company owns that have value (eg cash, computer systems. O E Owner’s Equity;.

The meaning is clear. Since, by definition, an asset must be controlled by the entity in order for it to be recognized in the financial statements, certain ‘Assets’ would not qualify for recognition Consider a highly dedicated workforce Generally speaking, a hardworking and motivated workforce is the most valuable asset of any successful company. Financial Assets Accounting Asset Definition In accounting, an asset has two criteria a company must own or control it, and it must be expected to generate future benefit for that company Assets on Balance Sheet A company records the value of its assets on the balance sheet Assets can be classified as current assets or as noncurrent assets.

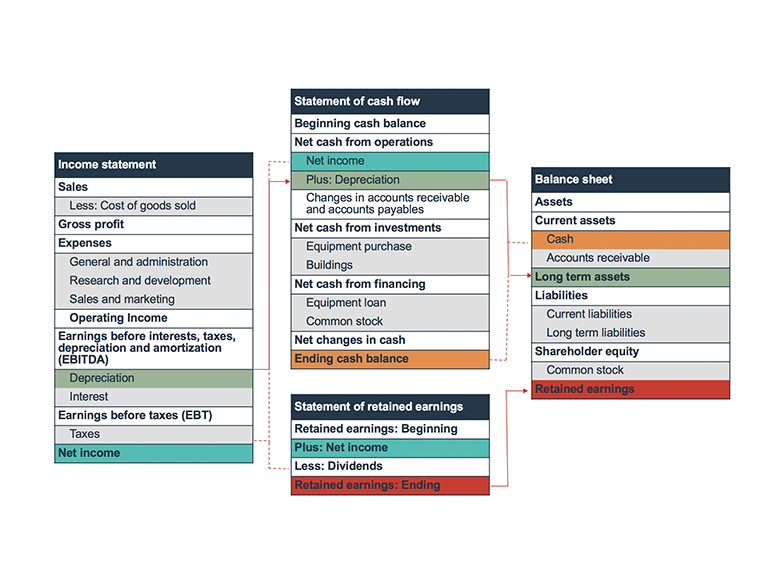

Asset disposal is the removal of a longterm asset from the company’s accounting records Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows These three core statements areIt is an important concept because capital assets are Types of Assets Common types of assets include current, non. Account Type Overview The five account types are Assets, Liabilities, Equity, Revenue (or Income) and ExpensesTo fully understand how to post transactions and read financial reports, we must understand these account typesWe'll define them briefly and then look at each one in detail Assets tangible and intangible items that the company owns that have value (eg cash, computer systems. An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill.

In accounting, the value of a company's total assets less its total liabilities and intangible assets Put another way, the book value is the shareholders' equity , or how much the company would be worth if it paid of all of its debts and liquidated immediately. Since, by definition, an asset must be controlled by the entity in order for it to be recognized in the financial statements, certain ‘Assets’ would not qualify for recognition Consider a highly dedicated workforce Generally speaking, a hardworking and motivated workforce is the most valuable asset of any successful company. The meaning is clear.

The general asset definition is anything possessed that is of value But what are assets in accounting?. In financial accounting, an asset is any resource owned or controlled by a business or an economic entity It is anything (tangible or intangible) that can be utilized to produce value and that is held by an economic entity and that could produce positive economic valueSimply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered. Assets, liabilities, equity and the accounting equation are the linchpin of your accounting system They tell you how much you have, how much you owe, and what’s left over They help you understand where that money is at any given point in time, and help ensure you haven’t made any mistakes recording your transactions.

For accounting and tax purposes, your reported expenditures are based on the depreciation period whether you pay for your equipment up front or in monthly loan installments If you do take out a loan, your interest payments are tax deductible, but they are expenses separate from the cost of the capitalized equipment. Assets in accounting are the medium through which business can be undertaken, are either tangible or intangible and have a monetary value can be associated with it due to the economic benefits that can be derived from them.

Assets In Accounting Definition Examples Of Assets On Balance Sheet

What Are Tangible Assets Definition And Meaning Market Business News

Definition Of Accounting

Asset Meaning In Accounting のギャラリー

Understanding Net Worth Ag Decision Maker

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

What Is A Fixed Asset Definition Types Formula Examples List

Contra Asset Examples How A Contra Asset Account Works

Definition Depreciation Is A Measure Of The Wearing Out Consumption Or Other Loss Of Value Of A Depreciable Asset Arising From Use Effluxion Of Time Ppt Download

Asset Definition What Are Assets Youtube

Equity Vs Asset Top 7 Best Differences With Infographics

Accounts Payable Explanation Accountingcoach

Meaning And Different Types Of Assets Classification More

Solved Objective This Activity Has The Purpose Of Helpin Chegg Com

How Transactions Impact The Accounting Equation Principlesofaccounting Com

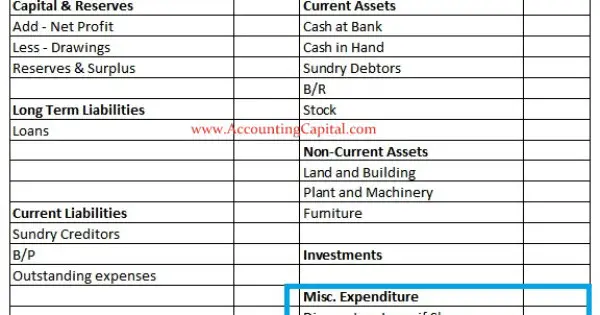

Current Assets Meaning Examples Quiz Accountingcapital

Contra Asset Account Definition List Examples With Accounting Entry

Unrestricted Net Assets Definition And Meaning Bookstime

/financial-statement--pen-and-calculator-on-table-1056767352-2494fc4d57674fb68f434061f777107c.jpg)

Accounting Goodwill And Analyzing A Balance Sheet

16 Types Of Intangible Assets Each Explained In Brief Efm

Impairment Cost Meaning Benefits Indicators And More

How To Calculate Assets A Step By Step Guide For Small Businesses

Total Assets Definition Explanation Video Lesson Transcript Study Com

Difference Between Tangible And Intangible Assets With Examples

Fictitious Assets Meaning Examples Quiz Accountingcapital

What Is Contra Account And Its Importance Tally Solutions

Assets Vs Liabilities Top 6 Differences With Infographics

Financial Statements Overview Objectives Double Entry Accounting

How To Find Total Current Assets The Motley Fool

What Is Meant By Fictitious Assets

What Is Equity Definition Example Guide To Understanding Equity

Fictitious Assets Meaning Examples Quiz Accountingcapital

Chart Of Accounts Explanation Accountingcoach

What Are Current Assets Definition Examples Calculation Video Lesson Transcript Study Com

Assets In Accounting Definition Examples Of Assets On Balance Sheet

What Is An Intangible Asset A Simple Definition For Small Business With Examples

Accounting 101 Assets

Plant Assets What Are They And How Do You Manage Them The Blueprint

Liquidation Basis Accounting And Reporting The Cpa Journal

Balance Sheet Explained In Detail With Example Edupristine

30 Basic Accounting Terms Acronyms And Abbreviations Students Should Know Rasmussen College

The Basics Of Accounting Boundless Accounting

Fixed Assets Definition Characteristics Examples

Chart Of Accounts Meaning Importance And More

Balance Sheet Explained In Detail With Example Edupristine

What Are Current Assets Definition Meaning List Examples Formula Types

Accounting Equation How Transactions Affects Accounting Equation

Debit Vs Credit

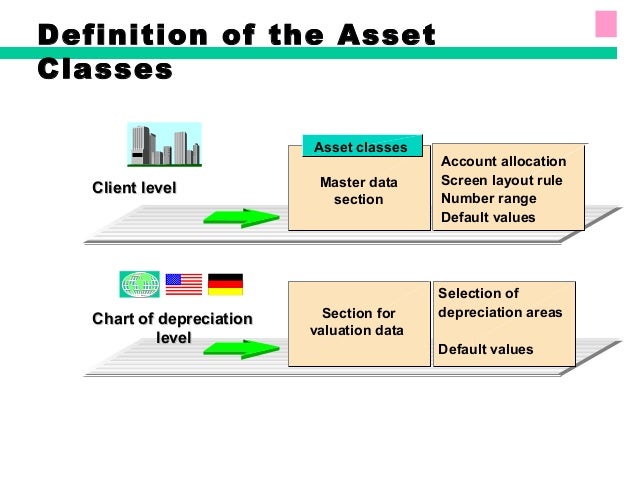

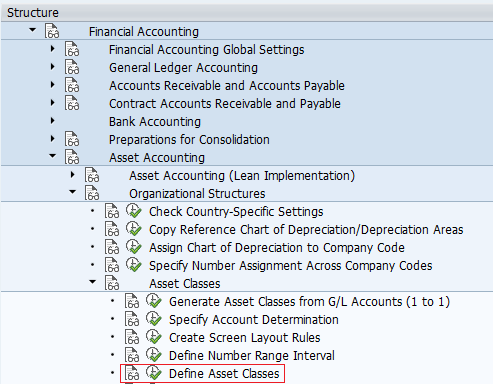

Sap Fixed Assets Accounting

What Are Current Assets Definition Examples Calculation Video Lesson Transcript Study Com

Bills Receivable In Accounting Double Entry Bookkeeping

Assets Liabilities Expenses Revenue And Income In Financial Accounting Urdu Hindi Lecture 2 Youtube

Liquid Assets Finance Investing Accounting Basics Finance Literacy

Fictitious Assets Meaning And Explanation Tutor S Tips

The Definition Of Assets In Accounting

Presentation Of Contract Assets And Contract Liabilities In Asc 606 Revenuehub

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

Property Plant And Equipment Pp E Definition

What Is The Accounting Equation Overview Formula And Example Bookstime

The Basics Of Accounting Boundless Accounting

Meaning Of Undervalued And Overvalued In Case Of An Asset And Its Treatment Also Are Liabilities Brainly In

What Are Fixed Assets Type Tangible Intangible Accounting Dep

Revalutaion Of Fixed Assets Meaning Purpose Journal Entry Methods Bookkeeping Business Fixed Asset Financial Accounting

Prepaid Expenses Definition Example Financial Edge Training

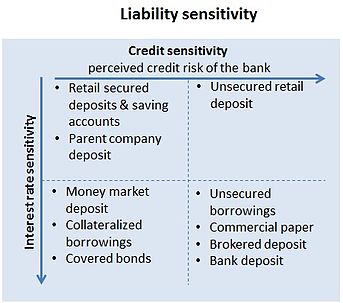

Asset And Liability Management Wikipedia

Assets In Accounting Identification Types And Learning How To Calculate Them

Fixed Assets Basics In Accounting Double Entry Bookkeeping

Write Off Meaning Examples What Is Write Off In Accounting

List Of Assets List Of Top 10 Balance Sheet Assets

Total Assets Definition Example Applications Of Total Assets

Accounting For Asset Exchanges Principlesofaccounting Com

Accounting Asset Definition The Strategic Cfothe Strategic Cfo

Solved Objective This Activity Has The Purpose Of Helpin Chegg Com

Assets Balance Sheet Definition

:max_bytes(150000):strip_icc()/what-is-your-net-worth-be7a33afb9da4529abd5e376b5d325c2.png)

Net Worth What Is It

What Are Assets Basic Accounting Terms In Urdu Hindi Youtube

How To Account For Assets And Expenses In Your Start Up c Ca

Net Identifiable Assets Purchase Price Allocation Goodwill In M A

Tangible Assets Meaning Importance Accounting And More

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Long Term Assets Definition

Asset Definition And Meaning Market Business News

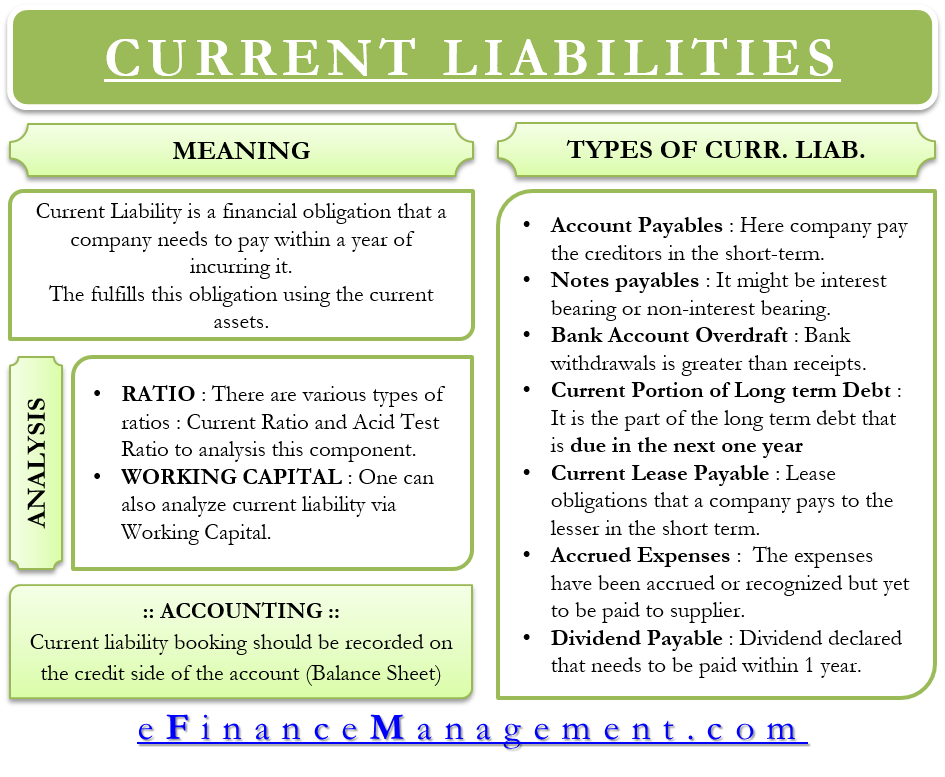

Current Liability Meaning Types Accounting And More

Impairment Of Assets What It Is How To Handle And More

How To Create Asset Classes In Sap What Is An Asset Class

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Statement Of Financial Position Nonprofit Accounting Basics

Current Assets Business Tutor2u

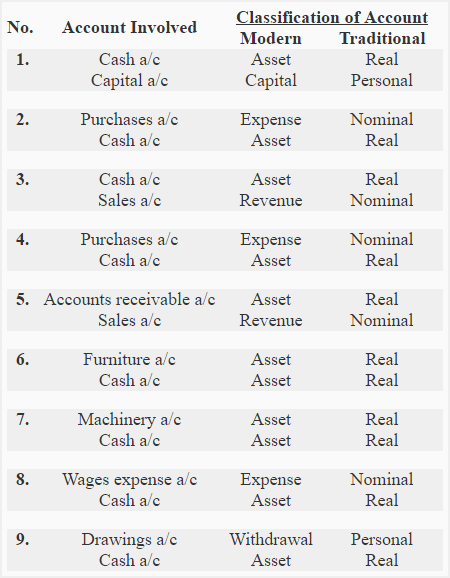

Classification Of Accounts Definition Explanation And Examples Accounting For Management

Tangible Vs Intangible Assets What S The Difference

Asset Definition And Meaning Market Business News

Looking At Fixed Assets In A Balance Sheet Dummies

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Accounting Basics Debits And Credits

Liquidation Basis Accounting And Reporting The Cpa Journal

Chapter 2 The Double Entry System For Assets Liabilities And Capital Ppt Download

What Is Inventory

How Do Intangible Assets Show On A Balance Sheet

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

Balance Sheet Definition

Intangible Assets Financial Accounting

What Are Assets And Liabilities A Simple Primer For Small Businesses

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

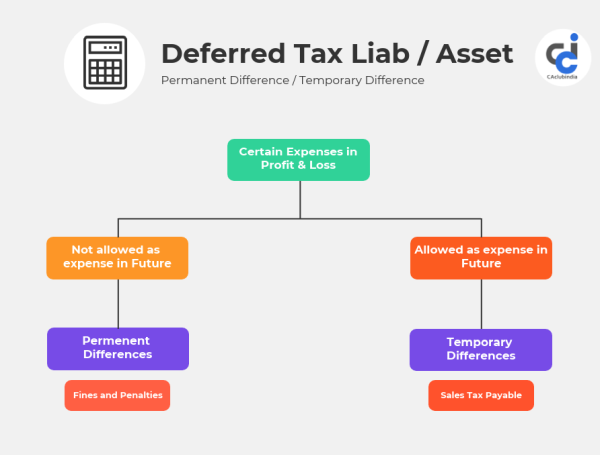

Meaning Of Deferred Tax Liability Asset In Simple Words